Tax Computation Worksheet

Tax Computation Worksheet flashcards provide concise definitions and examples of key tax concepts and calculations to enhance your understanding and application of tax principles.

You can download the Worksheet PDF, the Worksheet Answer Key and the Worksheet with Questions and Answers. Or build your own interactive worksheets with StudyBlaze.

Tax Computation Worksheet – PDF Version and Answer Key

{worksheet_pdf_keyword}

Download {worksheet_pdf_keyword}, including all questions and exercises. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_answer_keyword}

Download {worksheet_answer_keyword}, containing only the answers to each worksheet exercise. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_qa_keyword}

Download {worksheet_qa_keyword} to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use Tax Computation Worksheet

Tax Computation Worksheet serves as a structured tool that simplifies the process of calculating taxable income and determining tax liability for individuals or businesses. This worksheet typically includes sections for entering various sources of income, allowable deductions, and applicable credits, guiding users through each step of the computation. To effectively tackle the topic, it is crucial to gather all necessary financial documents beforehand, such as W-2 forms, 1099s, and receipts for deductible expenses. As you fill out the worksheet, pay close attention to the instructions for each section to ensure accurate data entry, and consider consulting the current tax regulations to maximize deductions and credits. Additionally, reviewing the completed worksheet for errors before submission can prevent potential issues with tax authorities.

Tax Computation Worksheet provides an effective and organized method for individuals to enhance their understanding of tax-related concepts and improve their computational skills. By utilizing flashcards, learners can engage in active recall, which has been shown to significantly boost retention and comprehension of complex tax topics. This interactive approach allows users to assess their knowledge in real-time, enabling them to identify areas where they excel and where improvement is needed. Furthermore, the repetitive practice with flashcards helps to reinforce key principles and formulas, making it easier to apply these concepts in practical scenarios. As individuals continue to work through the Tax Computation Worksheet flashcards, they can track their progress, thereby determining their skill level and gaining the confidence necessary to tackle more advanced tax computations. The convenience of flashcards also allows for learning on-the-go, making it easier to fit study sessions into busy schedules, ultimately leading to a more comprehensive understanding of tax computation.

How to improve after Tax Computation Worksheet

Learn additional tips and tricks how to improve after finishing the worksheet with our study guide.

After completing the Tax Computation Worksheet, students should focus on the following key areas to solidify their understanding of tax concepts and computation methods.

1. Understanding Tax Terms: Familiarize yourself with fundamental tax vocabulary such as taxable income, deductions, exemptions, credits, and tax brackets. Knowing the definitions and implications of these terms will aid in comprehending how taxes are calculated.

2. Tax Brackets: Review the current federal and state tax brackets. Understand how different income levels are taxed at varying rates and how this progressive taxation system affects overall tax liabilities. Make sure to practice calculating taxes owed at each bracket level.

3. Deductions and Credits: Study the difference between tax deductions and tax credits. Deductions reduce taxable income, while credits reduce the tax owed directly. Learn about common deductions (standard vs. itemized) and credits available for individuals and businesses.

4. Filing Status: Understand the different filing statuses (single, married filing jointly, married filing separately, head of household, and qualifying widow(er)) and how they influence tax rates and eligibility for certain deductions and credits.

5. Taxable Income Calculation: Practice calculating taxable income by taking gross income and subtract deductibles. Work on examples that include various sources of income such as wages, investment income, and rental income.

6. Special Considerations: Familiarize yourself with specific situations that may affect tax computation, including self-employment income, capital gains, and losses, as well as retirement account distributions.

7. Tax Forms: Learn about the various tax forms that individuals and businesses must file, such as Form 1040 for individuals, and understand what information is required on each form.

8. State Taxes: Explore the differences between federal and state tax systems. Understand how state taxes may differ in rates, deductions, and credits. Research the specific tax laws applicable to your state of residence.

9. Tax Planning Strategies: Consider strategies for tax planning and minimizing tax liabilities, such as utilizing tax-advantaged accounts (like IRAs and HSAs), timing of income and deductions, and taking advantage of available credits and deductions.

10. Current Tax Legislation: Stay updated on recent changes to tax laws and how they impact computations. Understanding new legislation will help in applying current rules accurately during tax preparation.

11. Practice Problems: Work through additional practice problems that involve various scenarios and complexities in tax computation. This will reinforce your understanding and prepare you for real-world applications.

12. Review Resources: Utilize textbooks, online tutorials, and IRS resources for additional information and clarification on tax topics.

By focusing on these areas, students can build a strong foundation in tax computation that goes beyond the worksheet and prepares them for more advanced studies in taxation and personal finance.

Create interactive worksheets with AI

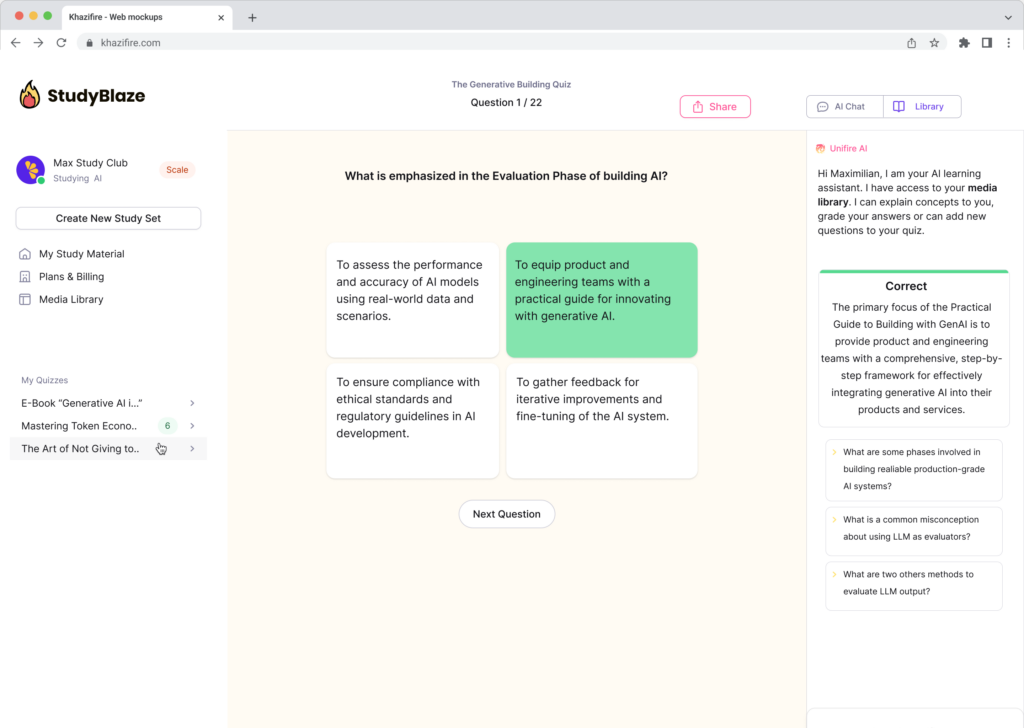

With StudyBlaze you can create personalised & interactive worksheets like Tax Computation Worksheet easily. Start from scratch or upload your course materials.