Spending Plan Worksheet

Spending Plan Worksheet flashcards provide essential tips and strategies for creating and managing a personal budget effectively.

You can download the Worksheet PDF, the Worksheet Answer Key and the Worksheet with Questions and Answers. Or build your own interactive worksheets with StudyBlaze.

Spending Plan Worksheet – PDF Version and Answer Key

{worksheet_pdf_keyword}

Download {worksheet_pdf_keyword}, including all questions and exercises. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_answer_keyword}

Download {worksheet_answer_keyword}, containing only the answers to each worksheet exercise. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_qa_keyword}

Download {worksheet_qa_keyword} to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use Spending Plan Worksheet

Spending Plan Worksheet is a practical tool designed to help individuals manage their finances effectively by tracking income and expenses. To utilize this worksheet, start by listing all sources of income, ensuring to include regular earnings, bonuses, and any side income. Next, categorize your expenses into fixed costs like rent and utilities, and variable costs such as groceries and entertainment. It’s crucial to be as detailed as possible, as this will provide a clear picture of where your money goes each month. After filling out these sections, compare total income to total expenses to identify surplus or deficit. If you find yourself spending more than you earn, consider adjusting your variable expenses, prioritizing needs over wants. Regularly revisiting and updating your Spending Plan Worksheet can help you stay on track and make informed financial decisions. Additionally, setting specific financial goals, like saving for a vacation or paying off debt, can provide motivation to stick to your budget.

Spending Plan Worksheet offers a structured approach to managing finances, making it easier for individuals to track their income and expenses effectively. By using this tool, people can identify their spending habits and pinpoint areas where they can save, ultimately leading to greater financial stability. Additionally, the worksheet allows users to determine their skill level in budgeting; as they fill it out, they can gauge how well they understand their financial situation and where they may need improvement. This self-assessment empowers users to set realistic financial goals and develop better money management skills, paving the way for informed decisions about spending and saving. With the benefits of clarity, accountability, and enhanced financial literacy, the Spending Plan Worksheet serves as an invaluable resource for anyone looking to take control of their financial future.

How to improve after Spending Plan Worksheet

Learn additional tips and tricks how to improve after finishing the worksheet with our study guide.

After completing the Spending Plan Worksheet, students should focus on several key areas to deepen their understanding of personal finance and budgeting.

First, review the concept of a spending plan and its importance in managing finances. A spending plan helps individuals track their income and expenses, ensuring they can meet their financial goals while living within their means. Students should understand how creating a spending plan can prevent overspending and promote savings.

Next, analyze the components of the Spending Plan Worksheet. Students should identify the different categories of income, such as salary, allowances, or any other sources of revenue. They should also look at various expense categories, including fixed expenses (like rent or mortgage) and variable expenses (like groceries or entertainment). Understanding these categories helps students allocate their income wisely.

After categorizing income and expenses, students should practice calculating their total income and total expenses. This calculation is crucial for determining whether they are living within their means or if adjustments are necessary. They should also learn how to identify discretionary spending and differentiate it from essential expenses.

Students should also focus on the concept of savings and how it fits into a spending plan. Understanding the importance of setting aside money for emergencies, future goals, or retirement is essential. They should learn how to incorporate savings into their spending plans, ensuring they prioritize their financial health.

Another area of focus should be analyzing spending habits. Students should reflect on their own spending patterns and identify areas where they can cut back. This self-reflection can lead to more conscious spending and better financial decisions in the future.

Consider discussing the importance of reviewing and adjusting the spending plan regularly. Life circumstances can change, influencing income and expenses. Students should learn how to revisit their spending plan periodically to make necessary adjustments and stay on track with their financial goals.

Additionally, explore the concept of financial goals. Students should understand the difference between short-term and long-term financial goals, as well as how to set realistic and achievable targets. Learning how to align their spending plan with these goals will help them stay motivated and focused.

Lastly, familiarize students with financial tools and resources that can assist in managing their spending plans. This could include budgeting apps, online calculators, or financial literacy websites. Encouraging students to utilize these tools can enhance their budgeting experience and promote financial literacy.

By focusing on these areas, students will gain a comprehensive understanding of personal finance and budgeting beyond the Spending Plan Worksheet, equipping them with the knowledge and skills necessary for making informed financial decisions in the future.

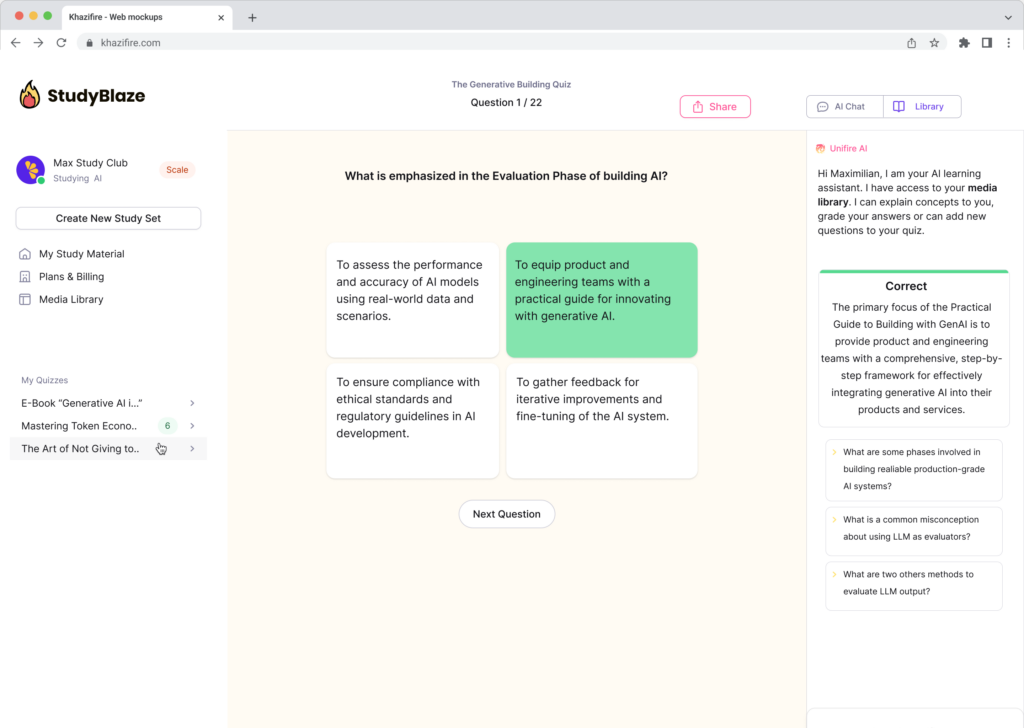

Create interactive worksheets with AI

With StudyBlaze you can create personalised & interactive worksheets like Spending Plan Worksheet easily. Start from scratch or upload your course materials.