Sales Tax Worksheet

Sales Tax Worksheet flashcards provide concise explanations and examples of calculating, applying, and reporting sales tax for various scenarios.

You can download the Worksheet PDF, the Worksheet Answer Key and the Worksheet with Questions and Answers. Or build your own interactive worksheets with StudyBlaze.

Sales Tax Worksheet – PDF Version and Answer Key

{worksheet_pdf_keyword}

Download {worksheet_pdf_keyword}, including all questions and exercises. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_answer_keyword}

Download {worksheet_answer_keyword}, containing only the answers to each worksheet exercise. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_qa_keyword}

Download {worksheet_qa_keyword} to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use Sales Tax Worksheet

Sales Tax Worksheet is designed to help individuals and businesses accurately calculate and track sales tax obligations for various transactions. This worksheet typically includes sections for recording the total sale amount, the applicable sales tax rate, and the calculated sales tax due. To effectively use this worksheet, begin by gathering all necessary transaction data, including invoices and receipts that detail both the net sales and the sales tax applied. It is crucial to familiarize yourself with the specific sales tax rates applicable to your region, as these can vary significantly from one jurisdiction to another. When filling out the worksheet, double-check each entry to ensure accuracy, and consider maintaining a systematic approach by organizing your transactions chronologically or by category. Additionally, regularly reviewing and updating the worksheet can help in identifying any discrepancies or trends in sales tax collection, ultimately aiding in compliance and financial planning.

Sales Tax Worksheet is an invaluable tool for anyone looking to enhance their understanding of sales tax calculations and compliance. By engaging with the flashcards, individuals can reinforce their knowledge through active recall, which has been shown to improve retention and mastery of complex concepts. These flashcards provide a structured way to assess one’s understanding of various sales tax scenarios, enabling users to identify areas where they excel and where they may need further study. This self-assessment not only builds confidence but also allows learners to track their progress over time, ensuring they are well-prepared for practical applications in real-world situations. Additionally, using the Sales Tax Worksheet flashcards can streamline the learning process, making it easier to digest information in manageable chunks, thereby enhancing overall comprehension and skill development in navigating sales tax regulations.

How to improve after Sales Tax Worksheet

Learn additional tips and tricks how to improve after finishing the worksheet with our study guide.

After completing the Sales Tax Worksheet, students should focus on several key areas to deepen their understanding of sales tax concepts and calculations.

First, review the definition of sales tax. Understand what it is, why it is charged, and how it varies by location. Research the different sales tax rates across various states or regions and how these rates can change based on local laws and regulations.

Next, practice calculating sales tax using different scenarios. Start with simple calculations where you determine the sales tax on a given purchase price using a specific rate. Then, progress to more complex problems that involve multiple items with different tax rates or discounts that affect the final price. Ensure you can express the final amount as both the subtotal and total including tax.

Focus on understanding how to apply sales tax in real-world situations. Consider how sales tax impacts consumers and businesses, and the importance of compliance for retailers. Explore the implications of tax-exempt purchases, such as those made by non-profit organizations or for certain essential goods. Study the documentation required for tax-exempt sales and familiarize yourself with any necessary forms or processes.

Investigate the relationship between sales tax and other types of taxes. Compare sales tax to income tax and property tax, discussing how they are calculated and collected. Discuss the purpose of these taxes and how they contribute to government revenue.

Additionally, pay attention to the legal and ethical considerations surrounding sales tax collection. Understand the responsibilities of sellers in collecting and remitting sales tax, and what consequences they may face for failing to comply with tax laws. Explore the concept of nexus and how it affects a business’s obligation to collect sales tax in different jurisdictions.

Consider current events or recent changes in sales tax legislation. Stay informed about any significant changes to sales tax laws that may impact consumers or businesses. Look for case studies or examples of how these changes have affected the economy or individual industries.

Lastly, engage in discussions or group activities related to sales tax. Collaborate with peers to solve problems or analyze case studies related to sales tax issues. This will not only reinforce your understanding but also help develop critical thinking skills as you navigate real-life applications of sales tax concepts.

By focusing on these areas, students will gain a comprehensive understanding of sales tax beyond the worksheet, preparing them for further studies in economics, accounting, or business management.

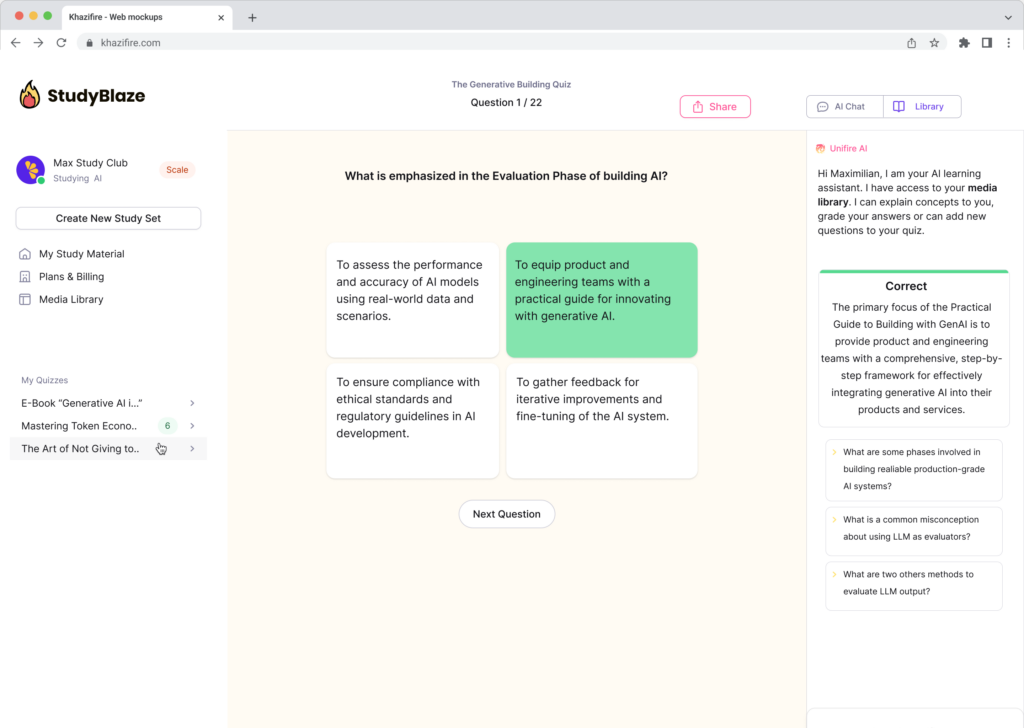

Create interactive worksheets with AI

With StudyBlaze you can create personalised & interactive worksheets like Sales Tax Worksheet easily. Start from scratch or upload your course materials.