Qualified Dividend And Capital Gain Worksheet

Qualified Dividend And Capital Gain Worksheet provides users with tailored flashcards that simplify the understanding of tax implications related to qualified dividends and capital gains.

You can download the Worksheet PDF, the Worksheet Answer Key and the Worksheet with Questions and Answers. Or build your own interactive worksheets with StudyBlaze.

Qualified Dividend And Capital Gain Worksheet – PDF Version and Answer Key

{worksheet_pdf_keyword}

Download {worksheet_pdf_keyword}, including all questions and exercises. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_answer_keyword}

Download {worksheet_answer_keyword}, containing only the answers to each worksheet exercise. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_qa_keyword}

Download {worksheet_qa_keyword} to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use Qualified Dividend And Capital Gain Worksheet

Qualified Dividend And Capital Gain Worksheet is designed to help taxpayers accurately report their qualified dividends and capital gains for tax purposes. This worksheet allows individuals to separate their capital gains into short-term and long-term categories, which is crucial for determining the appropriate tax rates that apply to each type of gain. To effectively tackle this topic, begin by gathering all relevant financial documents, including Form 1099-DIV and any brokerage statements that detail your investment income. Carefully review the instructions for the worksheet to ensure you understand how to categorize your dividends and gains correctly. It can be helpful to break down each section of the worksheet systematically, filling it out line by line, while double-check your calculations to avoid errors. Additionally, staying informed about current tax laws regarding qualified dividends and capital gains can provide clarity on how these factors impact your overall tax liability.

Qualified Dividend And Capital Gain Worksheet is an essential tool for individuals looking to enhance their understanding of investment income and tax implications. By utilizing this worksheet, users can easily categorize their dividends and capital gains, which not only streamlines the tax preparation process but also provides clarity on their overall financial health. Engaging with flashcards related to this topic allows learners to reinforce their knowledge through active recall, making it easier to remember key concepts and definitions. Additionally, these flashcards can help individuals assess their skill level by presenting questions that range from basic to advanced, enabling users to identify areas where they excel and topics that may require further study. This self-assessment can lead to more targeted learning, ensuring that individuals become more proficient in navigating investment income reporting. Ultimately, the Qualified Dividend And Capital Gain Worksheet, combined with flashcard practice, empowers users to make informed financial decisions while maximizing their tax efficiency.

How to improve after Qualified Dividend And Capital Gain Worksheet

Learn additional tips and tricks how to improve after finishing the worksheet with our study guide.

After completing the Qualified Dividend and Capital Gain Worksheet, students should focus on several key areas to reinforce their understanding and application of the concepts related to qualified dividends and capital gains.

First, students should review the definitions and characteristics of qualified dividends. This includes understanding what makes a dividend “qualified,” such as the holding period requirement and the type of stock from which the dividend is paid. They should be able to identify different types of dividends and be able to distinguish between qualified and non-qualified dividends.

Next, students should study the different types of capital gains, including short-term and long-term capital gains. They should understand how the holding period of an asset affects the tax rate applied to capital gains and the implications of selling assets at a profit versus at a loss. It’s important to grasp the concept of realized versus unrealized gains and how this affects taxable income.

Students should also familiarize themselves with the tax implications of qualified dividends and capital gains. This encompasses understanding the relevant tax rates, how these rates differ from ordinary income tax rates, and the specific thresholds that determine which tax rate applies to their income. They should explore how tax brackets work and the importance of knowing one’s taxable income when calculating taxes owed.

Additionally, students should practice filling out the Qualified Dividend and Capital Gain Worksheet accurately. This involves understanding how to report qualified dividends and capital gains on tax forms, including where to find the necessary information on tax documents such as 1099-DIV and 1099-B. They should also review examples of completed worksheets to understand common errors and areas of confusion.

Another important area is the implications of capital losses. Students should learn how to offset capital gains with capital losses and the limitations on how much of a capital loss can be deducted from ordinary income. They should also study the concept of carryover losses and how they can be applied in future tax years.

It is also beneficial for students to explore tax planning strategies related to dividends and capital gains. This includes discussions on tax-efficient investment strategies, the importance of asset allocation, and how to strategically sell investments to minimize tax liability.

Lastly, students should stay updated on any recent changes to tax laws that may affect qualified dividends and capital gains. Understanding the current tax landscape, including any shifts in legislation or tax rates, will help them make informed decisions regarding their investment strategies and tax planning.

In summary, students should focus on understanding the definitions, implications, and calculations related to qualified dividends and capital gains, practice completing relevant worksheets, and explore tax planning strategies to enhance their comprehension and application of these important financial concepts.

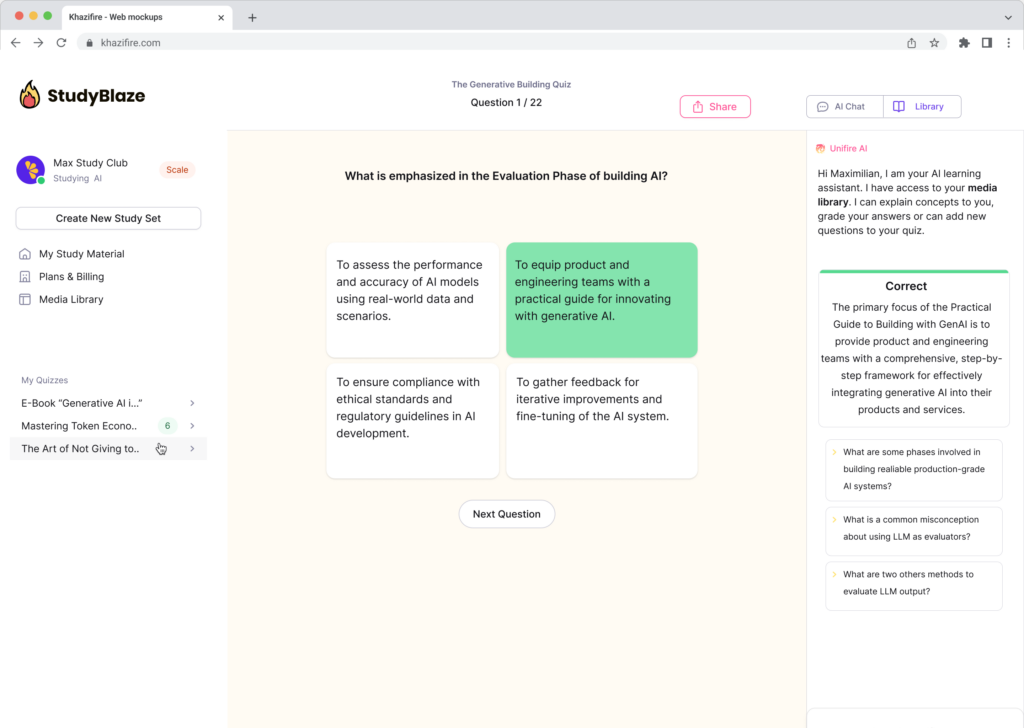

Create interactive worksheets with AI

With StudyBlaze you can create personalised & interactive worksheets like Qualified Dividend And Capital Gain Worksheet easily. Start from scratch or upload your course materials.