Profit And Loss Worksheet

Profit And Loss Worksheet flashcards provide concise definitions and examples to help users master key concepts related to financial performance tracking and analysis.

You can download the Worksheet PDF, the Worksheet Answer Key and the Worksheet with Questions and Answers. Or build your own interactive worksheets with StudyBlaze.

Profit And Loss Worksheet – PDF Version and Answer Key

{worksheet_pdf_keyword}

Download {worksheet_pdf_keyword}, including all questions and exercises. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_answer_keyword}

Download {worksheet_answer_keyword}, containing only the answers to each worksheet exercise. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_qa_keyword}

Download {worksheet_qa_keyword} to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use Profit And Loss Worksheet

Profit And Loss Worksheet is designed to help individuals and businesses track their financial performance over a specific period by detailing income and expenses. To effectively utilize this worksheet, start by categorizing all sources of income, such as sales revenue, interest, and any other earnings. Next, systematically list all expenses, breaking them down into fixed costs like rent and variable costs such as utilities and supplies. This structured approach allows for a clear view of net profit or loss by subtractively calculating total expenses from total income. To tackle this topic successfully, regularly update the worksheet to reflect any changes in income or expenses, and analyze trends over time to identify areas for improvement. Additionally, consider incorporating a comparison with previous periods to gauge financial growth or setbacks, ensuring that your financial decisions are informed and strategic.

Profit And Loss Worksheet is an essential tool for anyone looking to enhance their financial literacy and gain a clearer understanding of their financial situation. By utilizing flashcards, individuals can effectively learn and memorize key concepts related to profit and loss, making it easier to identify their strengths and weaknesses in this area. Flashcards facilitate active recall, which has been shown to improve retention and understanding, allowing users to grasp complex ideas more quickly. Additionally, they can help users assess their skill level by providing a straightforward way to track progress through self-quizzification and review. As individuals work through the flashcards, they can identify which areas they need to focus on for improvement, thereby creating a personalized learning experience. Ultimately, engaging with a Profit And Loss Worksheet through flashcards not only boosts confidence in handling financial matters but also equips users with the knowledge to make informed decisions about their finances.

How to improve after Profit And Loss Worksheet

Learn additional tips and tricks how to improve after finishing the worksheet with our study guide.

After completing the Profit and Loss Worksheet, students should focus on several key areas to deepen their understanding of financial concepts and enhance their analytical skills. Here’s a detailed study guide:

1. Understanding Profit and Loss Statement: Review the components of a Profit and Loss Statement (also known as an income statement). Understand the structure, including revenues, costs of goods sold (COGS), gross profit, operating expenses, and net profit. Learn how each component contributes to the overall financial health of a business.

2. Revenue Recognition: Study the principles behind revenue recognition, including the timing of when revenue is recorded and the different methods such as cash basis and accrual basis accounting. Understand the implications of each method on the Profit and Loss Statement.

3. Cost of Goods Sold (COGS): Research what constitutes COGS and how it affects gross profit. Learn how to calculate COGS and the importance of inventory management in determining accurate COGS figures.

4. Operating Expenses: Familiarize yourself with different types of operating expenses, such as fixed and variable costs. Understand how these expenses impact the net profit and overall profitability of a business.

5. Gross Profit vs. Net Profit: Study the differences between gross profit and net profit. Understand how gross profit indicates the efficiency of production or service delivery, while net profit reflects the overall profitability after all expenses are accounted for.

6. Profit Margins: Learn how to calculate and interpret profit margins, including gross profit margin, operating profit margin, and net profit margin. Understand the significance of these metrics in assessing business performance.

7. Break-even Analysis: Explore the concept of break-even analysis and how it relates to profit and loss. Learn to calculate the break-even point, which is the level of sales at which total revenues equal total costs, resulting in neither profit nor loss.

8. Variances and Budget Analysis: Study the importance of comparing actual profit and loss figures against budget projections. Understand how to analyze variances, identify trends, and make informed decisions based on this analysis.

9. Financial Ratios: Investigate key financial ratios related to profitability, such as return on equity (ROE), return on assets (ROA), and return on investment (ROI). Learn how these ratios can provide insights into a company’s financial performance and efficiency.

10. Case Studies: Review real-world case studies of businesses to see how they utilize Profit and Loss Statements in decision-making. Analyze how different strategies affect profitability and operational efficiency.

11. Software and Tools: Familiarize yourself with accounting software and financial tools used to create and analyze Profit and Loss Statements, such as QuickBooks, Excel, or specific financial management systems. Understand the advantages of using technology in financial reporting.

12. Regulatory Considerations: Research the regulatory environment governing financial reporting, including Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Understand the importance of compliance in financial reporting.

By focusing on these areas, students will enhance their comprehension of the Profit and Loss Worksheet and its significance in financial management. This comprehensive understanding will prepare them for advanced concepts in accounting and finance.

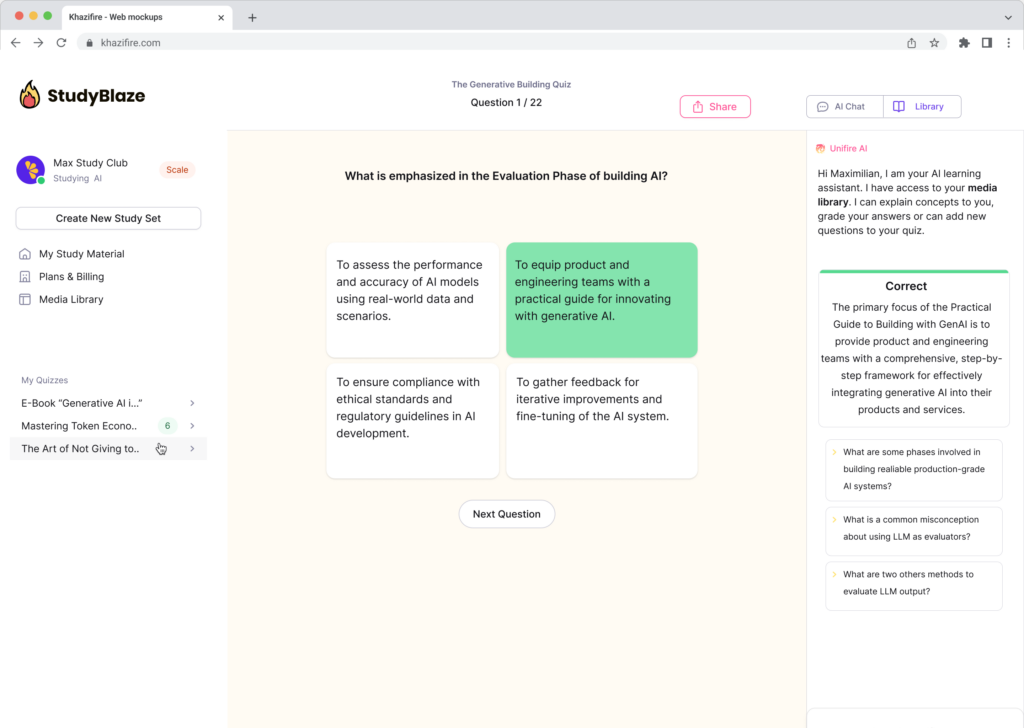

Create interactive worksheets with AI

With StudyBlaze you can create personalised & interactive worksheets like Profit And Loss Worksheet easily. Start from scratch or upload your course materials.