Money Management Worksheet

Money Management Worksheet flashcards provide concise tips and strategies to help users effectively track their finances and make informed budgeting decisions.

You can download the Worksheet PDF, the Worksheet Answer Key and the Worksheet with Questions and Answers. Or build your own interactive worksheets with StudyBlaze.

Money Management Worksheet – PDF Version and Answer Key

{worksheet_pdf_keyword}

Download {worksheet_pdf_keyword}, including all questions and exercises. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_answer_keyword}

Download {worksheet_answer_keyword}, containing only the answers to each worksheet exercise. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_qa_keyword}

Download {worksheet_qa_keyword} to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use Money Management Worksheet

The Money Management Worksheet serves as a practical tool designed to help individuals systematically track their income, expenses, and savings goals. To effectively utilize this worksheet, begin by accurately listing all sources of income, including salaries, freelance work, and any passive income streams. Next, categorize your expenses into fixed and variable costs, ensuring to account for both essentials, like rent and utilities, and discretionary spending, such as entertainment and dining out. This clear separation allows for a better understanding of where your money is going. After mapping out your financial inflows and outflows, set specific savings goals, whether for an emergency fund, a vacation, or retirement. It’s essential to regularly review and update the worksheet to reflect any changes in income or spending habits, enabling you to adjust your financial strategies accordingly. Additionally, consider using color coding or highlighting key areas to easily identify patterns or areas needing improvement. By approaching the Money Management Worksheet with discipline and consistency, you can cultivate a healthier relationship with your finances and work towards achieving your financial aspirations.

Money Management Worksheet serves as an invaluable tool for individuals seeking to enhance their financial literacy and control over their personal finances. By engaging with flashcards designed around key concepts of budgeting, saving, and investing, users can effectively reinforce their understanding of essential financial principles. These flashcards allow users to assess their knowledge in a structured manner, enabling them to identify areas of strength and those requiring further attention. This method of active recall not only aids in retention but also fosters a deeper comprehension of complex topics. Furthermore, as individuals progress through the flashcards, they can easily track improvements and determine their skill level, providing a clear pathway for ongoing financial education. Ultimately, utilizing a Money Management Worksheet in conjunction with flashcards empowers users to take charge of their financial future with confidence and clarity.

How to improve after Money Management Worksheet

Learn additional tips and tricks how to improve after finishing the worksheet with our study guide.

After completing the Money Management Worksheet, students should focus on several key areas to deepen their understanding and application of financial literacy concepts. Here’s a detailed study guide to assist in their review and further study.

1. Understanding Budget Basics: Students should revisit the principles of budgeting, including income versus expenses, fixed versus variable expenses, and the importance of tracking spending. They should practice creating a simple budget based on hypothetical income and expenses.

2. Savings Strategies: Explore different savings methods, including emergency funds, short-term and long-term savings goals, and high-yield savings accounts. Students should understand the importance of saving a percentage of their income and how compound interest can impact savings over time.

3. Debt Management: Review the types of debt (secured vs. unsecured) and the importance of managing debt responsibly. Students should study strategies for paying off debt, such as the snowball and avalanche methods, and the impact of interest rates on debt repayment.

4. Understanding Credit: Delving into credit scores and reports is crucial. Students should learn how credit scores are calculated, factors that influence them, and how to improve and maintain good credit. They should also understand the implications of poor credit and how it affects borrowing.

5. Investing Basics: Introduce the concept of investing and its importance in long-term financial planning. Students should study different investment vehicles, such as stocks, bonds, mutual funds, and real estate. They should also understand risk versus reward and the principle of diversification.

6. Financial Goals Setting: Encourage students to set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals. They should practice identifying short-term, medium-term, and long-term financial goals and developing plans to achieve them.

7. Understanding Financial Tools: Familiarize students with various financial tools and apps that can assist in budgeting, saving, and investing. They should explore how technology can simplify money management and track financial progress.

8. Basic Economic Principles: Review fundamental economic concepts that affect personal finance, such as inflation, interest rates, and economic cycles. Understanding these principles can help students make informed financial decisions.

9. Taxes and Income: Students should learn about different types of taxes (income tax, sales tax, property tax) and their implications for personal finance. They should understand the basics of filing taxes and how to plan for tax obligations.

10. Consumer Rights and Responsibilities: Discuss the rights consumers have when it comes to financial transactions and the importance of being informed. Students should learn about consumer protection laws and how to avoid scams.

11. Financial Planning for Life Events: Explore how different life events (college, marriage, buying a home, retirement) impact financial planning. Students should understand the importance of preparing for these events financially.

12. Review and Reflect: Encourage students to review their completed Money Management Worksheet. They should reflect on what they learned, identify areas for improvement, and consider how they can implement these lessons in their daily lives.

By focusing on these areas, students will enhance their financial literacy and be better prepared to manage their money effectively.

Create interactive worksheets with AI

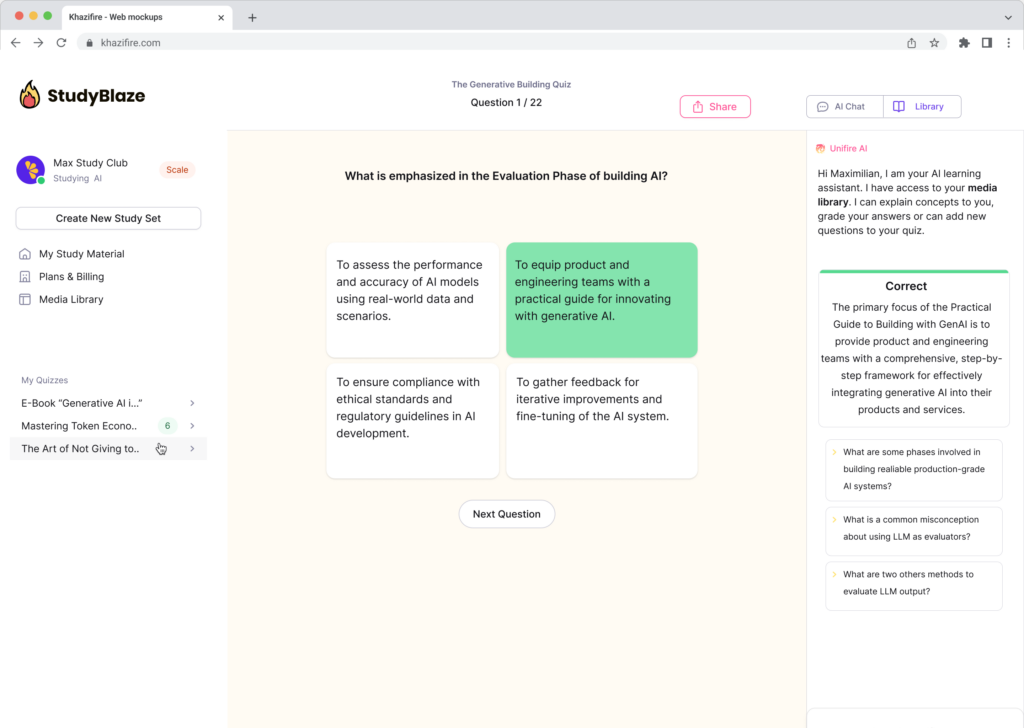

With StudyBlaze you can create personalised & interactive worksheets like Money Management Worksheet easily. Start from scratch or upload your course materials.