Financial Goal Worksheet Sudent Handout 2B

Financial Goal Worksheet Student Handout 2 B provides a structured approach to help students identify, articulate, and plan for their financial objectives effectively.

You can download the Worksheet PDF, the Worksheet Answer Key and the Worksheet with Questions and Answers. Or build your own interactive worksheets with StudyBlaze.

Financial Goal Worksheet Sudent Handout 2B – PDF Version and Answer Key

{worksheet_pdf_keyword}

Download {worksheet_pdf_keyword}, including all questions and exercises. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_answer_keyword}

Download {worksheet_answer_keyword}, containing only the answers to each worksheet exercise. No sign up or email required. Or create your own version using StudyBlaze.

{worksheet_qa_keyword}

Download {worksheet_qa_keyword} to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use Financial Goal Worksheet Sudent Handout 2B

The Financial Goal Worksheet Student Handout 2 B serves as a structured tool to help students articulate and plan their financial aspirations effectively. This worksheet prompts users to identify short-term, medium-term, and long-term financial goals, offering designated spaces to specify the objectives, associated costs, and target dates for achieving each goal. To tackle the topic effectively, students should start by brainstorming their desires and needs, categorizing them based on timelines, and being realistic about what can be achieved within those timeframes. It is also beneficial to break larger goals into smaller, actionable steps, which can make the process feel less overwhelming and more achievable. Additionally, students should consider potential obstacles and devise strategies for overcoming them, ensuring that their financial plans remain adaptable to changing circumstances. Engaging with this worksheet not only clarifies financial intentions but also instills a sense of accountability and motivation to work towards these goals systematically.

Financial Goal Worksheet Student Handout 2 B is an invaluable tool for anyone looking to enhance their financial literacy and achieve their financial aspirations. By using this worksheet, individuals can clearly outline their financial objectives, making it easier to visualize their goals and create actionable steps towards achieving them. Additionally, the worksheet allows users to assess their current financial situation, which is crucial for determining their skill level in budgeting, saving, and investing. This self-assessment not only highlights areas of strength but also identifies gaps in knowledge that can be addressed through further education or practical experience. Furthermore, the structured format of the Financial Goal Worksheet Student Handout 2 B encourages consistency in tracking progress over time, fostering a sense of accountability and motivation. Ultimately, leveraging this resource can empower individuals to take control of their financial future and cultivate habits that lead to long-term success.

How to improve after Financial Goal Worksheet Sudent Handout 2B

Learn additional tips and tricks how to improve after finishing the worksheet with our study guide.

To effectively prepare for the next steps following the completion of the Financial Goal Worksheet Student Handout 2 B, students should focus on several key areas that will enhance their understanding of financial planning and goal setting.

1. Understanding Financial Goals: Students should revisit the concept of financial goals and the importance of setting both short-term and long-term financial objectives. They should be able to differentiate between different types of goals, such as savings goals, investment goals, and debt repayment goals.

2. SMART Goals Framework: Students should study the SMART criteria for setting financial goals. This includes ensuring that their goals are Specific, Measurable, Achievable, Relevant, and Time-bound. Practicing how to apply this framework to their previously identified financial goals will be beneficial.

3. Budget Creation: After completing the worksheet, students should learn how to create a personal budget that aligns with their financial goals. This involves categorizing expenses, identifying fixed and variable costs, and determining how much can be allocated towards achieving their goals each month.

4. Savings Strategies: Students should explore various savings strategies that can help them reach their financial goals. This may include setting up automatic transfers to savings accounts, using high-yield savings accounts, and understanding the importance of an emergency fund.

5. Investment Basics: A foundational understanding of investment principles is crucial. Students should study different types of investments, such as stocks, bonds, mutual funds, and real estate, and how these can play a role in achieving long-term financial goals. They should also learn about risk tolerance and diversification.

6. Debt Management: It is important for students to understand the implications of debt on their financial goals. They should learn about different types of debt, strategies for managing and paying off debt, and how to avoid high-interest loans.

7. Financial Tracking and Review: Students should develop the habit of tracking their progress towards their financial goals regularly. They should study how to use financial tracking tools, apps, or spreadsheets to monitor their expenses, savings, and investment growth.

8. Adjustments and Flexibility: Financial planning is not static. Students should learn the importance of being flexible and willing to adjust their financial goals and strategies as life circumstances change. This includes adjusting budgets, reallocating funds, or revisiting goals as needed.

9. Resources and Tools: Finally, students should familiarize themselves with various resources and tools available for financial planning. This includes financial literacy websites, budgeting apps, investment platforms, and community resources that offer financial education workshops.

By focusing on these areas, students will reinforce their understanding of financial goal setting and develop practical skills that will aid them in achieving their financial objectives.

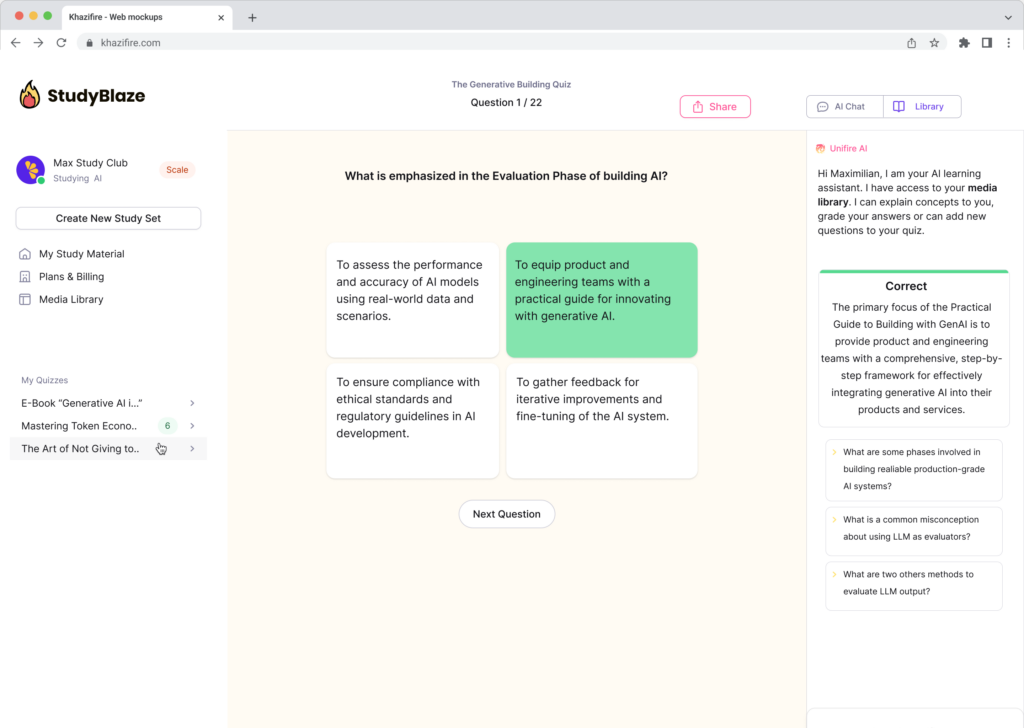

Create interactive worksheets with AI

With StudyBlaze you can create personalised & interactive worksheets like Financial Goal Worksheet Sudent Handout 2B easily. Start from scratch or upload your course materials.