Risk Vs Return Reading Quiz

Risk Vs Return Reading Quiz offers users an engaging way to assess their understanding of investment principles through 20 thought-provoking questions that challenge their knowledge of risk and return dynamics.

You can download the PDF version of the quiz and the Answer Key. Or build your own interactive quizzes with StudyBlaze.

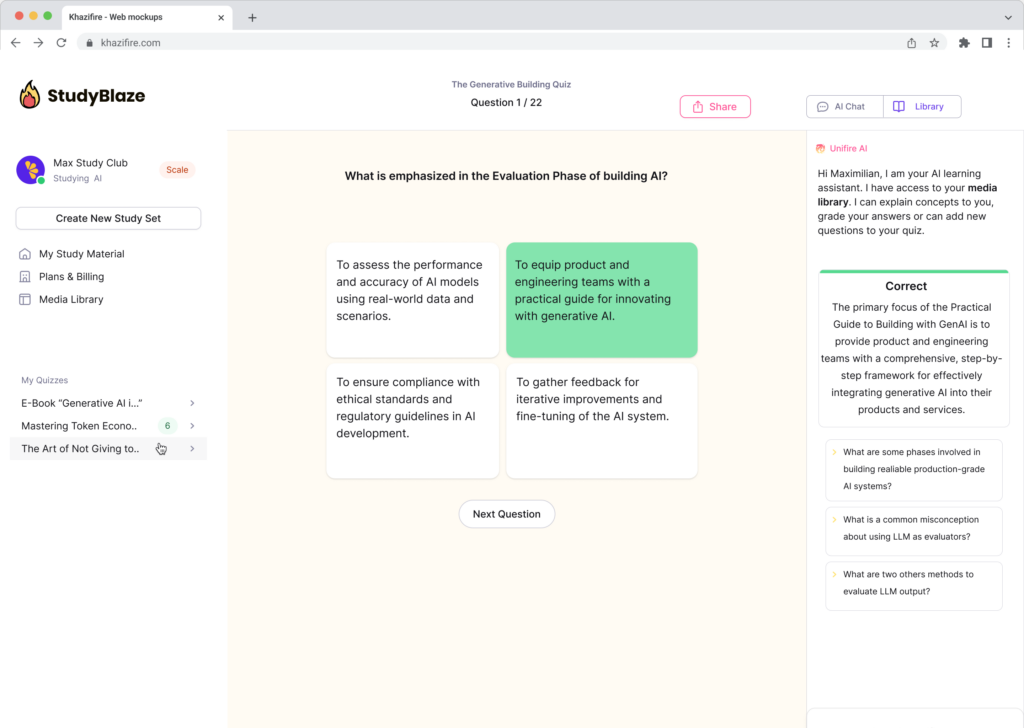

Create interactive quizzes with AI

With StudyBlaze you can create personalised & interactive worksheets like Risk Vs Return Reading Quiz easily. Start from scratch or upload your course materials.

Risk Vs Return Reading Quiz – PDF Version and Answer Key

Risk Vs Return Reading Quiz PDF

Download Risk Vs Return Reading Quiz PDF, including all questions. No sign up or email required. Or create your own version using StudyBlaze.

Risk Vs Return Reading Quiz Answer Key PDF

Download Risk Vs Return Reading Quiz Answer Key PDF, containing only the answers to each quiz questions. No sign up or email required. Or create your own version using StudyBlaze.

Risk Vs Return Reading Quiz Questions and Answers PDF

Download Risk Vs Return Reading Quiz Questions and Answers PDF to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use Risk Vs Return Reading Quiz

The Risk Vs Return Reading Quiz is designed to assess the participants’ understanding of the concepts related to risk and return in investment strategies. Upon initiation, the quiz generates a series of questions that are directly related to the reading material provided on the topic. Each question will typically be multiple-choice or true/false format, allowing participants to select their answers based on their comprehension of the reading. Once the participants complete the quiz by submitting their selected answers, the system automatically grades the responses by comparing them against a pre-defined answer key. The grading process is instantaneous, providing participants with immediate feedback on their performance, including the total score achieved and the correct answers for any questions that were answered incorrectly. This process ensures a straightforward and efficient evaluation of the participants’ grasp of the critical relationship between risk and return, enhancing their learning experience.

Engaging with the Risk Vs Return Reading Quiz offers individuals a unique opportunity to deepen their understanding of investment strategies and financial decision-making. By participating, users can expect to enhance their ability to evaluate potential investment opportunities, ultimately leading to more informed choices that align with their financial goals. This quiz encourages critical thinking and self-assessment, allowing participants to identify areas of strength and opportunities for improvement in their financial literacy. Additionally, it fosters an awareness of the inherent trade-offs between risk and return, empowering users to make decisions that reflect their risk tolerance and investment objectives. The insights gained from the Risk Vs Return Reading Quiz can significantly contribute to building a solid foundation for personal finance management and long-term wealth accumulation.

How to improve after Risk Vs Return Reading Quiz

Learn additional tips and tricks how to improve after finishing the quiz with our study guide.

Understanding the relationship between risk and return is fundamental to making informed investment decisions. In finance, risk refers to the potential for losing money or not achieving the expected returns, while return is the gain or profit that comes from an investment. Generally, higher potential returns are associated with higher levels of risk. This concept is often illustrated by the risk-return tradeoff, which suggests that investors must balance their desire for the highest possible return against their tolerance for risk. It is essential to evaluate various investment options, considering factors such as market volatility, economic conditions, and individual investment goals to determine the appropriate level of risk one is willing to accept.

To effectively manage risk, investors can employ several strategies, including diversification, asset allocation, and risk assessment techniques. Diversification involves spreading investments across various asset classes to reduce exposure to any single investment’s poor performance. Asset allocation is the process of deciding how to distribute an investor’s capital among different asset categories, such as stocks, bonds, and real estate, in accordance with their risk tolerance and investment objectives. Additionally, understanding the different types of risks—such as market risk, credit risk, and liquidity risk—can help investors make more informed decisions. By integrating these strategies and concepts, students can enhance their comprehension of risk and return, enabling them to navigate the complexities of investment choices effectively.