Diversification Reading Quiz

Diversification Reading Quiz offers users an engaging way to test their knowledge through 20 diverse questions, enhancing their understanding of key concepts in diversification.

You can download the PDF version of the quiz and the Answer Key. Or build your own interactive quizzes with StudyBlaze.

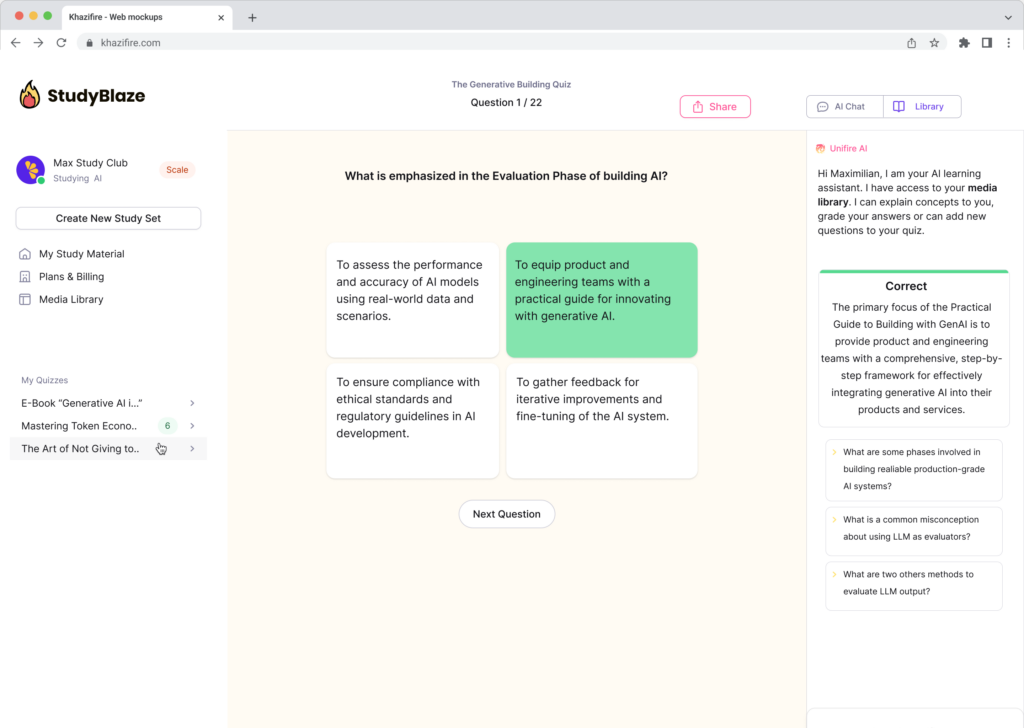

Create interactive quizzes with AI

With StudyBlaze you can create personalised & interactive worksheets like Diversification Reading Quiz easily. Start from scratch or upload your course materials.

Diversification Reading Quiz – PDF Version and Answer Key

Diversification Reading Quiz PDF

Download Diversification Reading Quiz PDF, including all questions. No sign up or email required. Or create your own version using StudyBlaze.

Diversification Reading Quiz Answer Key PDF

Download Diversification Reading Quiz Answer Key PDF, containing only the answers to each quiz questions. No sign up or email required. Or create your own version using StudyBlaze.

Diversification Reading Quiz Questions and Answers PDF

Download Diversification Reading Quiz Questions and Answers PDF to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use Diversification Reading Quiz

The Diversification Reading Quiz is designed to assess participants’ understanding of key concepts related to diversification in investment strategies. Upon initiation, the quiz generates a series of questions based on the material provided in the reading assignment. Each question is crafted to evaluate comprehension of critical themes, terminology, and principles discussed in the text. Participants will respond to multiple-choice or true/false questions, which are automatically graded upon completion. The system calculates the total score based on correct answers, providing instant feedback to the participant. This streamlined process allows for efficient assessment while reinforcing learning objectives related to the topic of diversification.

Engaging with the Diversification Reading Quiz offers numerous benefits for individuals seeking to enhance their financial literacy and investment strategies. By participating, users can expect to deepen their understanding of crucial concepts related to risk management and asset allocation, ultimately leading to more informed decision-making in their financial endeavors. The quiz encourages self-reflection and critical thinking, enabling participants to identify their own knowledge gaps and areas for improvement. Moreover, it serves as a valuable tool for reinforcing key principles of diversification, helping users to develop a more robust portfolio strategy that can withstand market fluctuations. This interactive experience not only boosts confidence in their investment choices but also fosters a sense of accomplishment and empowerment as they progress in their financial education journey.

How to improve after Diversification Reading Quiz

Learn additional tips and tricks how to improve after finishing the quiz with our study guide.

Diversification is a key concept in finance and investment strategy that involves spreading investments across various assets to reduce risk. The primary goal of diversification is to mitigate the impact of poor performance from any single investment on the overall portfolio. By holding a mix of asset types—such as stocks, bonds, real estate, and commodities—investors can protect themselves against volatility in any one sector or market. It is important to understand the different types of diversification, including across asset classes, geographical regions, and industries. This strategy is based on the principle that while some investments may perform poorly, others may perform well, thus balancing potential losses with gains.

To effectively implement a diversification strategy, investors should assess their risk tolerance, investment goals, and time horizon. A well-diversified portfolio takes into account the correlation between different assets; ideally, the selected investments should not move in tandem, as this can diminish the benefits of diversification. Additionally, periodic rebalancing is essential to maintain the desired level of diversification, as the performance of assets can shift over time, leading to an unintended concentration in certain areas. By understanding the fundamentals of diversification and applying them strategically, investors can enhance their potential for returns while minimizing risk, ultimately achieving a more resilient investment portfolio.