1.1.8 Quiz Financial Tools

1.1.8 Quiz Financial Tools offers users an engaging way to test their knowledge of financial concepts and improve their understanding through 20 diverse questions.

You can download the PDF version of the quiz and the Answer Key. Or build your own interactive quizzes with StudyBlaze.

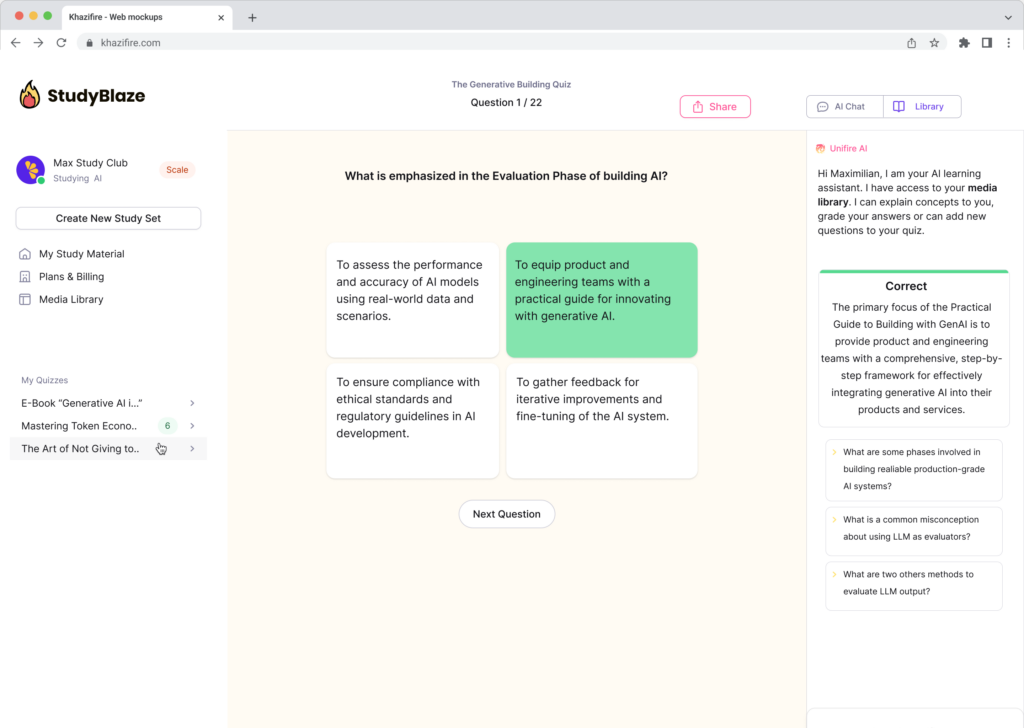

Create interactive quizzes with AI

With StudyBlaze you can create personalised & interactive worksheets like 1.1.8 Quiz Financial Tools easily. Start from scratch or upload your course materials.

1.1.8 Quiz Financial Tools – PDF Version and Answer Key

1.1.8 Quiz PDF Financial Tools

Download 1.1.8 Quiz PDF Financial Tools, including all questions. No sign up or email required. Or create your own version using StudyBlaze.

1.1.8 Quiz Answer Key PDF Financial Tools

Download 1.1.8 Quiz Answer Key PDF Financial Tools, containing only the answers to each quiz questions. No sign up or email required. Or create your own version using StudyBlaze.

1.1.8 Quiz Questions and Answers PDF Financial Tools

Download 1.1.8 Quiz Questions and Answers PDF Financial Tools to get all questions and answers, nicely separated – no sign up or email required. Or create your own version using StudyBlaze.

How to use 1.1.8 Quiz Financial Tools

“The 1.1.8 Quiz Financial Tools operates as a straightforward assessment tool designed to evaluate users’ understanding of various financial concepts and instruments. Upon initiation, the quiz generates a series of questions related to financial tools, which may include topics such as investments, budgeting, loans, and financial markets. Each question is presented in a multiple-choice format, allowing participants to select the most appropriate answer from a set of options. Once users have completed the quiz, the system automatically grades their responses by comparing them against a pre-established answer key. The grading process produces instant feedback, enabling participants to see their scores and identify areas for improvement. This automated approach ensures a streamlined experience, allowing users to focus on learning about financial tools without the complexities of manual grading or feedback mechanisms. Overall, the quiz serves as an effective means of reinforcing financial knowledge through simple question generation and immediate assessment.”

Engaging with the 1.1.8 Quiz Financial Tools offers a unique opportunity for individuals to deepen their understanding of financial literacy, enabling them to make informed decisions about their personal finances. Participants can expect to uncover insights that highlight their strengths and areas for improvement, paving the way for more strategic budgeting, saving, and investment practices. This quiz serves as a powerful tool for self-reflection, helping users identify their financial goals and obstacles, which ultimately fosters greater confidence in managing their money. By participating in the 1.1.8 Quiz Financial Tools, individuals can gain clarity on complex financial concepts, empowering them to navigate their financial journeys with enhanced knowledge and a more robust skill set. Additionally, the experience can spark motivation to engage further with financial education resources, leading to long-term benefits in financial well-being and stability.

How to improve after 1.1.8 Quiz Financial Tools

Learn additional tips and tricks how to improve after finishing the quiz with our study guide.

“To master the topic of financial tools, it’s essential to understand the various instruments available for managing finances and making informed decisions. Start by familiarizing yourself with the different types of financial tools, such as budgeting software, investment calculators, and retirement planning resources. These tools can help you track your expenses, set financial goals, and evaluate the potential returns of various investment options. Additionally, explore the importance of credit scores and reports, as they play a crucial role in determining loan eligibility and interest rates. Understanding how to read and interpret these financial documents will empower you to make better financial choices.

Next, practice using these financial tools through real-life scenarios. Create a personal budget using budgeting software to gain insights into your spending habits and identify areas for improvement. Use investment calculators to assess the impact of different investment strategies on your long-term financial goals. Additionally, consider simulating retirement planning by inputting various saving rates and retirement ages to see how they affect your future financial stability. By engaging with these tools and applying them to your financial planning, you’ll not only reinforce your understanding but also equip yourself with the skills necessary to navigate your financial future confidently.”