Arkusz kalkulacyjny dotyczący ubezpieczenia społecznego podlegającego opodatkowaniu

Karty pracy dotyczące podlegających opodatkowaniu świadczeń z ubezpieczenia społecznego zawierają zwięzłe wyjaśnienia i przykłady, które pomogą Ci zrozumieć, jak obliczać i zgłaszać opodatkowane części świadczeń z ubezpieczenia społecznego.

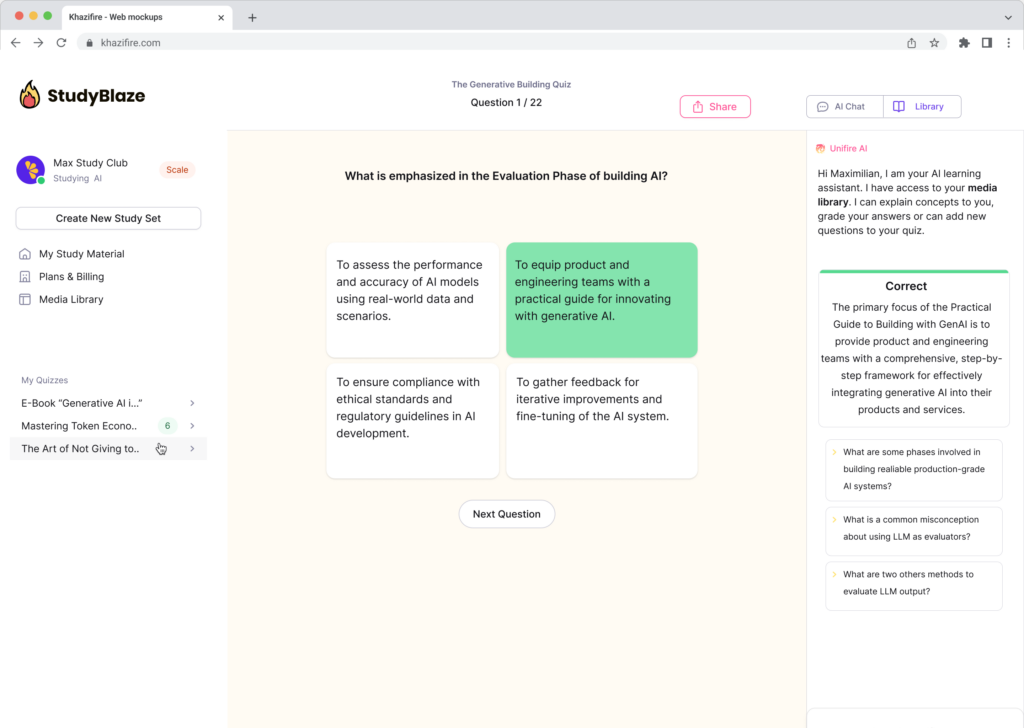

Możesz pobrać Arkusz roboczy PDFThe Klucz odpowiedzi w arkuszu ćwiczeń i Arkusz z pytaniami i odpowiedziami. Możesz też tworzyć własne interaktywne arkusze ćwiczeń za pomocą StudyBlaze.

Arkusz kalkulacyjny dotyczący ubezpieczenia społecznego podlegającego opodatkowaniu – wersja PDF i klucz odpowiedzi

{arkusz_pdf_słowo_kluczowe}

Pobierz {worksheet_pdf_keyword}, w tym wszystkie pytania i ćwiczenia. Nie jest wymagana żadna rejestracja ani e-mail. Możesz też utworzyć własną wersję, używając StudyBlaze.

{arkusz_odpowiedzi_słowo_kluczowe}

Pobierz {worksheet_answer_keyword}, zawierający tylko odpowiedzi na każde ćwiczenie z arkusza. Nie jest wymagana żadna rejestracja ani e-mail. Możesz też utworzyć własną wersję, używając StudyBlaze.

{słowo kluczowe_arkusza_arkusza_qa}

Pobierz {worksheet_qa_keyword}, aby uzyskać wszystkie pytania i odpowiedzi, ładnie oddzielone – bez konieczności rejestracji lub e-maila. Możesz też utworzyć własną wersję, używając StudyBlaze.

Jak korzystać z arkusza kalkulacyjnego dotyczącego ubezpieczenia społecznego podlegającego opodatkowaniu

Arkusz kalkulacyjny dotyczący podatku dochodowego od osób prawnych ma pomóc osobom fizycznym określić kwotę świadczeń z tytułu ubezpieczenia społecznego podlegających federalnemu podatkowi dochodowemu. Arkusz kalkulacyjny prowadzi użytkowników przez szereg obliczeń, zaczynając od ich całkowitego dochodu, który obejmuje wynagrodzenia, emerytury i inne źródła dochodu. Dodając wszelkie zwolnione z podatku odsetki i połowę otrzymanych świadczeń z tytułu ubezpieczenia społecznego, użytkownicy uzyskują „łączny dochód”. Następnie tę liczbę porównuje się z określonymi progami, które określają, jaka część świadczeń z tytułu ubezpieczenia społecznego będzie podlegać opodatkowaniu. Aby skutecznie zająć się tym tematem, kluczowe jest wcześniejsze zebranie wszystkich niezbędnych dokumentów finansowych, w tym oświadczeń z tytułu ubezpieczenia społecznego i wszelkich innych rejestrów dochodów. Zwróć szczególną uwagę na progi dochodowe, ponieważ mogą się one różnić w zależności od statusu zgłoszenia. Ponadto rozważ skonsultowanie się z oprogramowaniem podatkowym lub specjalistą, jeśli obliczenia wydają się skomplikowane, aby upewnić się, że dokładnie zgłaszasz swój dochód podlegający opodatkowaniu i maksymalizujesz potencjalne odliczenia.

Taxable Social Security Worksheet oferuje osobom fizycznym skuteczny sposób na pogłębienie wiedzy na temat świadczeń Social Security i ich skutków podatkowych. Korzystając z tych fiszek, użytkownicy mogą aktywnie angażować się w materiał, co ułatwia zapamiętywanie kluczowych pojęć i terminów związanych z opodatkowanym dochodem. To praktyczne podejście nie tylko wzmacnia naukę, ale także pozwala osobom fizycznym ocenić swoją obecną wiedzę i zidentyfikować obszary wymagające poprawy. W miarę postępów w korzystaniu z fiszek mogą ocenić swój poziom umiejętności, testując swoją zdolność do dokładnego i szybkiego odpowiadania na pytania, co pozwala im śledzić swój rozwój w czasie. Ostatecznie Taxable Social Security Worksheet służy jako cenne narzędzie edukacyjne, które upraszcza złożone informacje, promuje zapamiętywanie i pozwala użytkownikom na poruszanie się po swoich obowiązkach finansowych z pewnością siebie.

Jak poprawić arkusz kalkulacyjny dotyczący ubezpieczenia społecznego podlegającego opodatkowaniu

Poznaj dodatkowe wskazówki i porady, jak poprawić swoją wiedzę po ukończeniu arkusza ćwiczeń, korzystając z naszego przewodnika do nauki.

Po ukończeniu Taxable Social Security Worksheet uczniowie powinni skupić się na zrozumieniu kilku kluczowych obszarów, aby utrwalić swoje zrozumienie i zastosowanie zaangażowanych koncepcji. Następujące tematy powinny zostać dogłębnie przestudiowane:

1. Zrozumienie świadczeń z ubezpieczenia społecznego: Studenci powinni przejrzeć, czym są świadczenia z ubezpieczenia społecznego, jak są obliczane i na jakich warunkach osoby kwalifikują się do tych świadczeń. Obejmuje to zrozumienie różnych rodzajów świadczeń, takich jak emerytura, renta inwalidzka i świadczenia dla osób pozostających przy życiu.

2. Opodatkowanie świadczeń z Ubezpieczeń Społecznych: Istotne jest zrozumienie zasad regulujących opodatkowanie świadczeń z Ubezpieczeń Społecznych. Studenci powinni zapoznać się z progami dochodów, które decydują o tym, czy świadczenia z Ubezpieczeń Społecznych podlegają opodatkowaniu, oraz z tym, w jaki sposób progi te różnią się w zależności od statusu rozliczeniowego (osoba samotna, małżonkowie rozliczający się wspólnie, małżonkowie rozliczający się oddzielnie).

3. Obliczanie dochodu tymczasowego: Studenci muszą nauczyć się, jak obliczać dochód tymczasowy, który jest wykorzystywany do określania opodatkowania świadczeń z tytułu Ubezpieczeń Społecznych. Obejmuje to zrozumienie, co uznaje się za dochód tymczasowy, taki jak skorygowany dochód brutto, odsetki zwolnione z podatku i połowa świadczeń z tytułu Ubezpieczeń Społecznych.

4. Formularze podatkowe i raportowanie: Znajomość konkretnych formularzy podatkowych używanych do raportowania dochodów z Social Security jest niezbędna. Studenci powinni zapoznać się z formularzem 1040, w szczególności sekcjami dotyczącymi świadczeń Social Security, i zrozumieć, jak prawidłowo raportować opodatkowane i nieopodatkowane części.

5. Konsekwencje opodatkowania dochodów z tytułu ubezpieczenia społecznego: Studenci powinni zapoznać się z konsekwencjami posiadania dochodu z tytułu ubezpieczenia społecznego podlegającego opodatkowaniu, w tym z tym, jak wpływa to na całkowite zobowiązania podatkowe i potencjalny wpływ na kwalifikowalność do innych ulg i świadczeń podatkowych.

6. Rozważania dotyczące podatków stanowych: Podczas gdy świadczenia z tytułu ubezpieczeń społecznych nie są na ogół opodatkowane na szczeblu federalnym, studenci powinni zbadać, jak różne stany traktują świadczenia z tytułu ubezpieczeń społecznych na potrzeby podatku dochodowego stanowego. Obejmuje to zrozumienie różnic w przepisach podatkowych i zwolnieniach.

7. Strategie minimalizacji zobowiązań podatkowych: Studenci powinni ocenić potencjalne strategie minimalizacji zobowiązań podatkowych związanych ze świadczeniami z ubezpieczenia społecznego. Może to obejmować techniki planowania podatkowego, takie jak ustalanie terminów wypłat z kont emerytalnych lub dostosowywanie poziomu dochodów, aby pozostać poniżej progów podatkowych.

8. Wpływ innych dochodów: Ważne jest zrozumienie, w jaki sposób inne źródła dochodów (takie jak dochód z emerytury, inwestycje i wynagrodzenia) mogą wpływać na opodatkowanie świadczeń z tytułu ubezpieczenia społecznego. Uczniowie powinni analizować scenariusze, aby zobaczyć, w jaki sposób różne poziomy dochodów oddziałują na świadczenia z tytułu ubezpieczenia społecznego.

9. Ostatnie ustawodawstwo i zmiany: Bądź na bieżąco z wszelkimi ostatnimi zmianami w przepisach podatkowych lub regulacjach Social Security, które mogą mieć wpływ na opodatkowanie świadczeń. Zrozumienie aktualizacji ustawodawstwa zapewni, że studenci będą świadomi obecnych praktyk i potencjalnych przyszłych zmian.

10. Praktyczne zastosowania i scenariusze: Na koniec uczniowie powinni zaangażować się w praktyczne zastosowania, pracując nad różnymi scenariuszami, które obejmują różne poziomy dochodów, statusy składania zeznań i rodzaje świadczeń Social Security. Ta praktyka praktyczna pomoże wzmocnić ich zrozumienie, jak skutecznie stosować Taxable Social Security Worksheet w sytuacjach z życia wziętych.

Koncentrując się na tych obszarach, studenci rozwiną wszechstronną wiedzę na temat skutków podatkowych świadczeń z tytułu zabezpieczenia społecznego, co będzie miało kluczowe znaczenie dla ich przyszłych studiów i praktycznego wykorzystania w zakresie opodatkowania i planowania finansowego.

Twórz interaktywne arkusze kalkulacyjne za pomocą sztucznej inteligencji

Dzięki StudyBlaze możesz łatwo tworzyć spersonalizowane i interaktywne arkusze kalkulacyjne, takie jak Taxable Social Security Worksheet. Zacznij od zera lub prześlij materiały kursu.