Arkusz kalkulacyjny dotyczący kwalifikowanych dywidend i zysków kapitałowych 2023

Qualified Dividends And Capital Gains Worksheet 2023 flashcards provide concise summaries of key concepts and calculations related to the taxation of dividends and capital gains for the tax year 2023.

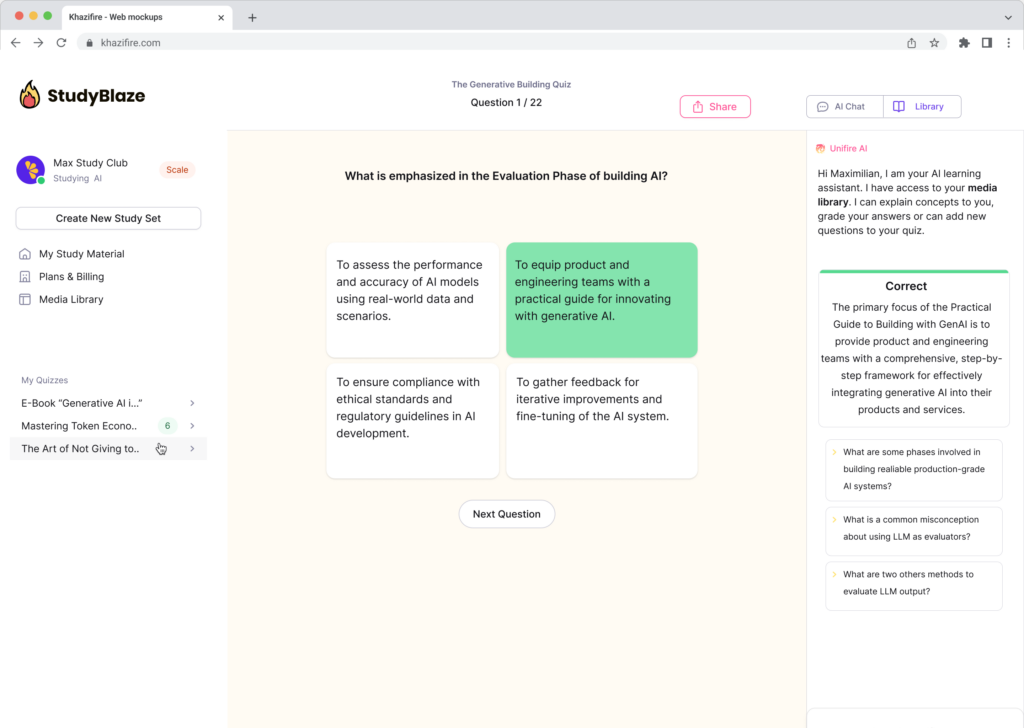

Możesz pobrać Arkusz roboczy PDFThe Klucz odpowiedzi w arkuszu ćwiczeń i Arkusz z pytaniami i odpowiedziami. Możesz też tworzyć własne interaktywne arkusze ćwiczeń za pomocą StudyBlaze.

Qualified Dividends And Capital Gains Worksheet 2023 – PDF Version and Answer Key

{arkusz_pdf_słowo_kluczowe}

Pobierz {worksheet_pdf_keyword}, w tym wszystkie pytania i ćwiczenia. Nie jest wymagana żadna rejestracja ani e-mail. Możesz też utworzyć własną wersję, używając StudyBlaze.

{arkusz_odpowiedzi_słowo_kluczowe}

Pobierz {worksheet_answer_keyword}, zawierający tylko odpowiedzi na każde ćwiczenie z arkusza. Nie jest wymagana żadna rejestracja ani e-mail. Możesz też utworzyć własną wersję, używając StudyBlaze.

{słowo kluczowe_arkusza_arkusza_qa}

Pobierz {worksheet_qa_keyword}, aby uzyskać wszystkie pytania i odpowiedzi, ładnie oddzielone – bez konieczności rejestracji lub e-maila. Możesz też utworzyć własną wersję, używając StudyBlaze.

How to use Qualified Dividends And Capital Gains Worksheet 2023

Qualified Dividends And Capital Gains Worksheet 2023 is designed to help taxpayers accurately calculate their tax liability on qualified dividends and capital gains. To effectively use this worksheet, begin by gathering all relevant financial documents, including Form 1099-DIV, which reports dividends received, and any records of capital transactions. The worksheet guides you through the process of segregating ordinary income from qualified dividends and long-term capital gains, which are taxed at more favorable rates. Pay close attention to the tax rates that apply to these categories, as they differ from ordinary income rates. It’s essential to fill out the worksheet step by step, ensuring that each entry is based on precise figures from your financial documents. Additionally, consider consulting the IRS instructions for the worksheet, as they provide valuable insights and examples that can clarify any complexities. For those with multiple sources of income or complex investment portfolios, it may be wise to seek assistance from a tax professional to ensure compliance and optimize your tax situation.

Qualified Dividends And Capital Gains Worksheet 2023 is an essential tool for anyone looking to enhance their understanding of tax implications related to investment income. By utilizing flashcards that focus on the key concepts and terms associated with this worksheet, individuals can effectively reinforce their knowledge and improve retention of critical information. Flashcards facilitate active recall, allowing users to test themselves on various topics, which can help identify areas of strength and weakness in their understanding of qualified dividends and capital gains. This interactive learning method not only makes studying more engaging but also provides a clear gauge of one’s skill level, enabling learners to track progress over time. Furthermore, by mastering the content on the flashcards, individuals can approach tax season with greater confidence and clarity, ensuring they make informed financial decisions that optimize their tax outcomes. Ultimately, the use of flashcards in conjunction with the Qualified Dividends And Capital Gains Worksheet 2023 empowers individuals to navigate the complexities of investment income with greater ease and expertise.

How to improve after Qualified Dividends And Capital Gains Worksheet 2023

Poznaj dodatkowe wskazówki i porady, jak poprawić swoją wiedzę po ukończeniu arkusza ćwiczeń, korzystając z naszego przewodnika do nauki.

After completing the Qualified Dividends and Capital Gains Worksheet for 2023, students should focus on several key areas to ensure a thorough understanding of the concepts involved. This study guide outlines essential topics and concepts to review.

1. Understanding Qualified Dividends:

– Definition of qualified dividends and how they differ from ordinary dividends.

– Criteria for dividends to be classified as qualified, including holding period requirements and the type of stock.

– Importance of qualified dividends in tax calculations and their favorable tax rates.

2. Tax Rates for Qualified Dividends:

– Review the current tax rates for qualified dividends, which can be 0%, 15%, or 20% depending on the taxpayer’s income level.

– Understand how the thresholds for these tax rates are determined and how they apply to different filing statuses (single, married filing jointly, etc.).

3. Capital Gains Overview:

– Definition of capital gains and the difference between short-term and long-term capital gains.

– Explanation of how capital gains are realized, including the sale and transfer of assets.

– Importance of holding period in determining whether a gain is classified as short-term or long-term.

4. Tax Rates for Capital Gains:

– Review the tax rates for long-term capital gains in comparison to short-term capital gains.

– Understand how long-term capital gains are taxed at the same rates as qualified dividends.

– Examine the implications of capital losses and how they can offset capital gains for tax purposes.

5. Filling Out the Worksheet:

– Step-by-step guide to accurately completing the Qualified Dividends and Capital Gains Worksheet.

– Importance of including all relevant income and ensuring that calculations align with IRS guidelines.

– Tips for double-checks and common mistakes to avoid when filling out the worksheet.

6. Interplay Between Qualified Dividends and Capital Gains:

– Understand how qualified dividends and capital gains are reported on tax returns, specifically on Form 1040.

– Review the significance of the Qualified Dividends and Capital Gains Worksheet in determining the overall tax liability.

7. Tax Planning Strategies:

– Explore tax planning strategies that can minimize tax liability related to dividends and capital gains.

– Discussion of tax-loss harvesting and timing of asset sales to optimize tax outcomes.

8. Recent Changes and Updates:

– Stay informed about any changes to tax laws that may affect qualified dividends and capital gains for the current tax year.

– Review IRS guidelines and publications for the latest updates on tax treatment of dividends and capital gains.

9. Problemy z praktyką:

– Work through practice problems that involve calculating qualified dividends and capital gains.

– Apply knowledge to real-world scenarios to reinforce understanding of how these concepts impact tax calculations.

10. Zasoby do dalszej nauki:

– Identify reliable resources for further information, including IRS publications, tax preparation software tutorials, and online financial education platforms.

– Consider study groups or forums where students can discuss concepts and clarify doubts with peers.

By focusing on these areas, students will gain a comprehensive understanding of qualified dividends and capital gains, enabling them to navigate their tax implications effectively. This knowledge is crucial not only for academic success but also for practical financial management.

Twórz interaktywne arkusze kalkulacyjne za pomocą sztucznej inteligencji

With StudyBlaze you can create personalised & interactive worksheets like Qualified Dividends And Capital Gains Worksheet 2023 easily. Start from scratch or upload your course materials.