Arkusz Celów Finansowych Materiały Uczniowskie 2B

Arkusz celów finansowych – materiały dla ucznia 2 B – to ustrukturyzowane podejście, dzięki któremu uczniowie będą mogli skutecznie identyfikować, planować i śledzić swoje cele finansowe.

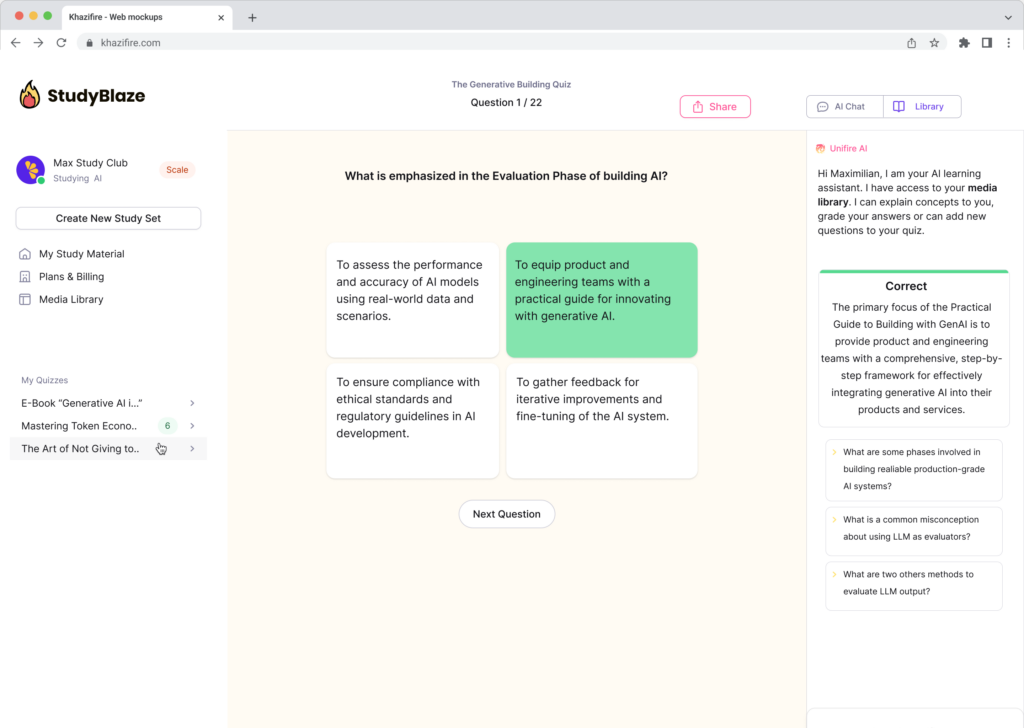

Możesz pobrać Arkusz roboczy PDFThe Klucz odpowiedzi w arkuszu ćwiczeń i Arkusz z pytaniami i odpowiedziami. Możesz też tworzyć własne interaktywne arkusze ćwiczeń za pomocą StudyBlaze.

Arkusz Celów Finansowych Materiały dla Studentów 2B – Wersja PDF i Klucz Odpowiedzi

{arkusz_pdf_słowo_kluczowe}

Pobierz {worksheet_pdf_keyword}, w tym wszystkie pytania i ćwiczenia. Nie jest wymagana żadna rejestracja ani e-mail. Możesz też utworzyć własną wersję, używając StudyBlaze.

{arkusz_odpowiedzi_słowo_kluczowe}

Pobierz {worksheet_answer_keyword}, zawierający tylko odpowiedzi na każde ćwiczenie z arkusza. Nie jest wymagana żadna rejestracja ani e-mail. Możesz też utworzyć własną wersję, używając StudyBlaze.

{słowo kluczowe_arkusza_arkusza_qa}

Pobierz {worksheet_qa_keyword}, aby uzyskać wszystkie pytania i odpowiedzi, ładnie oddzielone – bez konieczności rejestracji lub e-maila. Możesz też utworzyć własną wersję, używając StudyBlaze.

Jak korzystać z Arkusza Celów Finansowych Materiały dla Studentów 2B

Arkusz Celów Finansowych Materiały dla Studentów 2 B zostały opracowane, aby pomóc studentom skutecznie identyfikować, formułować i ustalać priorytety swoich celów finansowych. Ten arkusz prowadzi użytkowników przez serię podpowiedzi i ustrukturyzowanych sekcji, aby wyjaśnić zarówno krótkoterminowe, jak i długoterminowe cele finansowe. Aby skutecznie korzystać z tego arkusza, zacznij od zastanowienia się nad swoimi osobistymi aspiracjami, takimi jak oszczędzanie na studia, zakup samochodu lub planowanie podróży. Podziel te cele na wykonalne kroki, biorąc pod uwagę takie czynniki, jak wymagana kwota pieniędzy, ramy czasowe i potencjalne przeszkody. Korzystne jest kategoryzowanie celów na natychmiastowe, średnioterminowe i długoterminowe, aby utrzymać koncentrację i motywację. Ponadto regularne przeglądanie i dostosowywanie celów w miarę zmiany okoliczności może pomóc Ci zachować zgodność z Twoimi aspiracjami finansowymi. Traktując ten arkusz jako dynamiczne narzędzie, a nie jednorazowe zadanie, możesz wspierać proaktywne podejście do zarządzania swoimi finansami i osiągania celów.

Arkusz Celów Finansowych Student Handout 2 B to nieocenione narzędzie dla każdego, kto chce poprawić swoją wiedzę finansową i osiągnąć osobiste cele finansowe. Korzystając z tego arkusza, osoby mogą wyraźnie określić swoje krótkoterminowe i długoterminowe cele finansowe, co ułatwia śledzenie postępów w czasie. To ustrukturyzowane podejście nie tylko pomaga w identyfikacji konkretnych celów, ale także umożliwia użytkownikom ocenę ich obecnego poziomu umiejętności w zakresie zarządzania finansami osobistymi. Wypełniając arkusz, osoby mogą rozpoznać obszary, w których się wyróżniają, i zidentyfikować umiejętności, które wymagają poprawy, co sprzyja proaktywnemu nastawieniu do edukacji finansowej. Ponadto proces regularnego przeglądania i aktualizowania arkusza zachęca do odpowiedzialności i motywacji, ponieważ użytkownicy mogą świętować kamienie milowe i dostosowywać swoje strategie w razie potrzeby. Ostatecznie Arkusz Celów Finansowych Student Handout 2 B pozwala użytkownikom przejąć kontrolę nad swoją finansową przyszłością, co prowadzi do większej pewności siebie i świadomego podejmowania decyzji.

Jak poprawić się po Arkuszu celów finansowych Materiały dla uczniów 2B

Poznaj dodatkowe wskazówki i porady, jak poprawić swoją wiedzę po ukończeniu arkusza ćwiczeń, korzystając z naszego przewodnika do nauki.

Aby skutecznie przygotować się po wypełnieniu Arkusza celów finansowych dla ucznia, materiał 2 B, uczniowie powinni skupić się na następujących obszarach:

Zrozumienie celów finansowych: Przejrzyj różne rodzaje celów finansowych – krótkoterminowe, średnioterminowe i długoterminowe. Poznaj cechy każdego rodzaju i bądź w stanie podać przykłady. Zrozum, jak ustalać priorytety tych celów w oparciu o osobiste okoliczności i wartości.

Kryteria SMART: Przejrzyj kryteria SMART dotyczące ustalania celów finansowych: Konkretne, Mierzalne, Osiągalne, Istotne i Ograniczone czasowo. Upewnij się, że możesz zastosować te ramy do celów, które określiłeś w arkuszu kalkulacyjnym. Ćwicz tworzenie celów SMART dla różnych sytuacji finansowych.

Tworzenie budżetu: Zapoznaj się z podstawami tworzenia budżetu. Zrozum znaczenie śledzenia dochodów i wydatków. Dowiedz się, jak kategoryzować wydatki na koszty stałe i zmienne oraz jak wpływa to na Twoją zdolność do osiągania celów finansowych.

Strategie oszczędzania: Poznaj różne strategie oszczędzania, które mogą pomóc w osiągnięciu celów finansowych. Zbadaj znaczenie funduszu awaryjnego, kont oszczędnościowych o wysokiej rentowności i zautomatyzowanych oszczędności. Dowiedz się, jak stopy procentowe i kapitalizacja mogą wpływać na oszczędności w czasie.

Zarządzanie długiem: Zbadaj wpływ długu na cele finansowe. Dowiedz się o różnych rodzajach długu, w tym o długu zabezpieczonym i niezabezpieczonym. Poznaj strategie redukcji długu, takie jak metoda kuli śnieżnej i lawiny, oraz jak ustalić priorytety spłaty długu.

Podstawy inwestowania: Zacznij rozumieć podstawy inwestowania. Zrozum różnicę między oszczędzaniem a inwestowaniem i zapoznaj się z różnymi instrumentami inwestycyjnymi, takimi jak akcje, obligacje i fundusze inwestycyjne. Poznaj ryzyko i potencjalne zyski związane z każdym rodzajem inwestycji.

Wartość pieniądza w czasie: Poznaj koncepcję wartości pieniądza w czasie i jej wpływ na planowanie finansowe. Dowiedz się więcej o obliczeniach wartości bieżącej i przyszłej oraz zrozum, jak inflacja może wpłynąć na Twoje cele finansowe.

Tworzenie planu finansowego: Dowiedz się, jak stworzyć kompleksowy plan finansowy, który uwzględnia Twoje cele finansowe, budżet, oszczędności i strategie inwestycyjne. Zrozum, jak ważne jest regularne przeglądanie i dostosowywanie planu finansowego, aby utrzymać się na właściwej drodze.

Narzędzia i zasoby finansowe: Zbadaj różne dostępne narzędzia i zasoby finansowe, takie jak aplikacje do budżetowania, kalkulatory finansowe i witryny edukacyjne. Dowiedz się, w jaki sposób te narzędzia mogą pomóc w osiągnięciu celów finansowych.

Osobista refleksja: poświęć czas na refleksję nad swoimi osobistymi wartościami i tym, jak są one zgodne z Twoimi celami finansowymi. Zastanów się, co motywuje Cię do oszczędzania i inwestowania oraz w jaki sposób Twoje cele finansowe mogą przyczynić się do Twojej ogólnej satysfakcji z życia.

Koncentrując się na tych obszarach, uczniowie utrwalą wiedzę zdobytą w ramach Arkusza ćwiczeń z celami finansowymi, materiał dla ucznia 2 B, i zdobędą głębszą wiedzę na temat finansów osobistych, co pomoże im w osiągnięciu celów finansowych.

Twórz interaktywne arkusze kalkulacyjne za pomocą sztucznej inteligencji

Dzięki StudyBlaze możesz łatwo tworzyć spersonalizowane i interaktywne arkusze kalkulacyjne, takie jak Financial Goal Worksheet Student Handout 2B. Zacznij od zera lub prześlij materiały kursu.