Arkusz kalkulacyjny dotyczący odsetek składanych

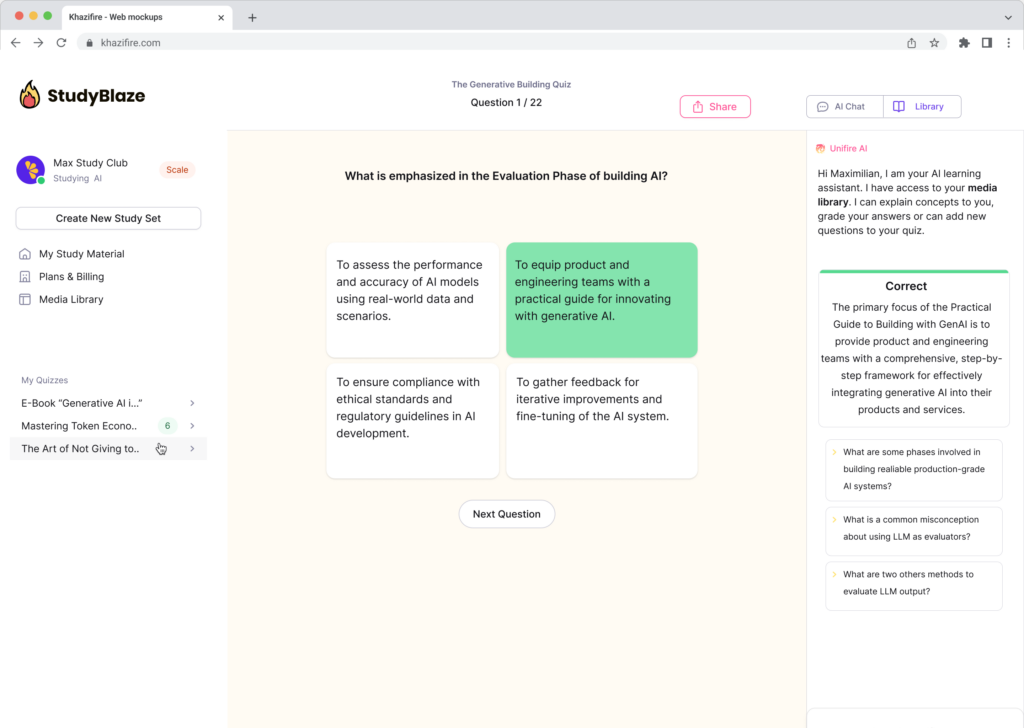

Compound Interest Worksheet provides engaging flashcards that help users master the concepts and calculations related to compound interest.

Możesz pobrać Arkusz roboczy PDFThe Klucz odpowiedzi w arkuszu ćwiczeń i Arkusz z pytaniami i odpowiedziami. Możesz też tworzyć własne interaktywne arkusze ćwiczeń za pomocą StudyBlaze.

Compound Interest Worksheet – PDF Version and Answer Key

{arkusz_pdf_słowo_kluczowe}

Pobierz {worksheet_pdf_keyword}, w tym wszystkie pytania i ćwiczenia. Nie jest wymagana żadna rejestracja ani e-mail. Możesz też utworzyć własną wersję, używając StudyBlaze.

{arkusz_odpowiedzi_słowo_kluczowe}

Pobierz {worksheet_answer_keyword}, zawierający tylko odpowiedzi na każde ćwiczenie z arkusza. Nie jest wymagana żadna rejestracja ani e-mail. Możesz też utworzyć własną wersję, używając StudyBlaze.

{słowo kluczowe_arkusza_arkusza_qa}

Pobierz {worksheet_qa_keyword}, aby uzyskać wszystkie pytania i odpowiedzi, ładnie oddzielone – bez konieczności rejestracji lub e-maila. Możesz też utworzyć własną wersję, używając StudyBlaze.

Jak korzystać z Arkusza kalkulacyjnego dotyczącego odsetek składanych

The Compound Interest Worksheet serves as a practical tool for understanding the principles of compound interest through various scenarios. This worksheet typically includes sections for inputting the principal amount, interest rate, compounding frequency, and the investment duration, allowing users to calculate the total accumulated value over time. To effectively tackle the topic, it is beneficial to familiarize yourself with the formula for compound interest, which is A = P(1 + r/n)^(nt), where A represents the total amount, P is the principal, r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years. Additionally, working through different examples on the worksheet can solidify your understanding; try varying the interest rate and compounding frequency to see how they affect the final amount. This hands-on approach not only enhances comprehension but also builds confidence in applying these concepts in real-world financial situations.

Compound Interest Worksheet offers an effective and engaging way for individuals to enhance their understanding and application of compound interest concepts. By utilizing these worksheets, learners can actively practice calculating compound interest, which solidifies their grasp of financial principles while also allowing them to visualize the impact of interest rates over time. This hands-on approach helps individuals pinpoint their current skill level, as they can track their progress through various problem sets and identify areas where they may struggle. Additionally, the iterative nature of using flashcards promotes retention of information, enabling users to recall formulas and processes more efficiently. Overall, engaging with Compound Interest Worksheets not only boosts confidence in financial literacy but also equips learners with essential skills for making informed financial decisions in their personal and professional lives.

How to improve after Compound Interest Worksheet

Poznaj dodatkowe wskazówki i porady, jak poprawić swoją wiedzę po ukończeniu arkusza ćwiczeń, korzystając z naszego przewodnika do nauki.

After completing the Compound Interest Worksheet, students should focus on the following key areas to deepen their understanding of compound interest and its applications.

1. Definition of Compound Interest: Understand what compound interest is and how it differs from simple interest. Review the formula for compound interest, which is A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest, P is the principal amount (the initial sum of money), r is the annual interest rate (decimal), n is the number of times that interest is compounded per year, and t is the number of years the money is invested or borrowed.

2. Components of the Formula: Break down each component of the compound interest formula. Understand how changes in the principal amount, interest rate, compounding frequency, and time affect the total amount accumulated.

3. Real-Life Applications: Explore real-life scenarios where compound interest is applicable, such as savings accounts, loans, mortgages, and investments. Discuss the importance of understanding compound interest in financial planning and decision-making.

4. Comparing Compound and Simple Interest: Create a comparison between compound interest and simple interest. Analyze examples to see how compound interest can lead to significantly higher returns over time compared to simple interest, especially with longer time periods and higher interest rates.

5. Compounding Frequency: Investigate how the frequency of compounding (annually, semi-annually, quarterly, monthly, daily) impacts the total amount of interest earned or paid. Calculate the effects of different compounding frequencies on the same principal amount and interest rate over a set period.

6. Future Value and Present Value: Learn about the concepts of future value and present value in the context of compound interest. Understand how to calculate the future value of an investment and the present value of an amount to be received in the future.

7. Graphical Representation: Create graphs to visualize how compound interest grows over time. Use different interest rates and compounding frequencies to compare growth curves.

8. Problem-Solving Practice: Work on additional practice problems that involve calculating compound interest in various scenarios. Include problems with different principal amounts, interest rates, time periods, and compounding frequencies.

9. Financial Literacy: Discuss the importance of financial literacy and how understanding compound interest can lead to better financial decisions. Explore topics like saving for retirement, education funds, and the impact of debt.

10. Technology and Tools: Familiarize yourself with financial calculators and spreadsheet software that can be used to quickly calculate compound interest. Learn how to set up formulas in spreadsheets to automate calculations for various scenarios.

By studying these areas, students will solidify their understanding of compound interest and its relevance in real-world financial situations.

Twórz interaktywne arkusze kalkulacyjne za pomocą sztucznej inteligencji

Dzięki StudyBlaze możesz łatwo tworzyć spersonalizowane i interaktywne arkusze kalkulacyjne, takie jak Compound Interest Worksheet. Zacznij od zera lub prześlij materiały kursu.