Osinko- ja pääomaverotaulukko

Qualified Dividends And Capital Tax Worksheet provides comprehensive flashcards that break down the intricacies of tax implications for qualified dividends and capital gains, enhancing your understanding of tax reporting and calculations.

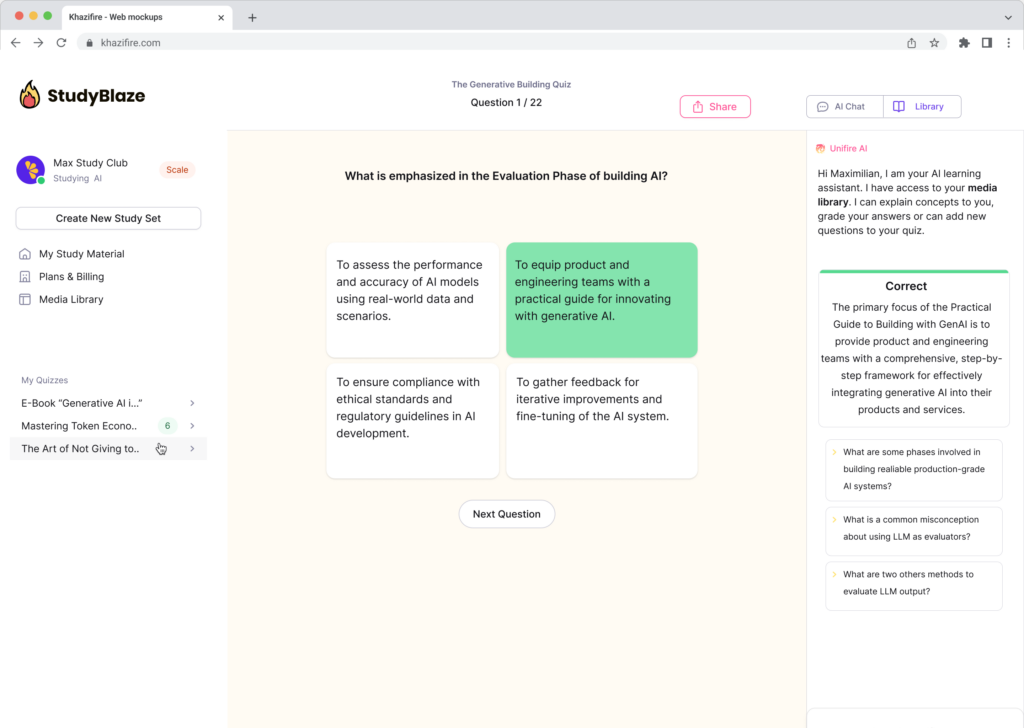

Voit ladata Työtaulukko PDF, The Työarkin vastausavain ja Tehtävätaulukko, jossa on kysymyksiä ja vastauksia. Tai luo omia interaktiivisia laskentataulukoita StudyBlazen avulla.

Qualified Dividends And Capital Tax Worksheet – PDF Version and Answer Key

{työtaulukko_pdf_avainsana}

Lataa {worksheet_pdf_keyword}, joka sisältää kaikki kysymykset ja harjoitukset. Ei vaadi rekisteröitymistä tai sähköpostia. Tai luo oma versio käyttämällä StudyBlaze.

{worksheet_answer_keyword}

Lataa {worksheet_answer_keyword}, joka sisältää vain vastaukset kuhunkin laskentataulukkoon. Ei vaadi rekisteröitymistä tai sähköpostia. Tai luo oma versio käyttämällä StudyBlaze.

{worksheet_qa_keyword}

Lataa {worksheet_qa_keyword}, niin saat kaikki kysymykset ja vastaukset kauniisti erotettuina – ei vaadi rekisteröitymistä tai sähköpostia. Tai luo oma versio käyttämällä StudyBlaze.

How to use Qualified Dividends And Capital Tax Worksheet

Qualified Dividends And Capital Tax Worksheet is a valuable tool for taxpayers to calculate the tax owed on qualified dividends and long-term capital gains. This worksheet guides users through the process of determining the appropriate tax rate based on their taxable income and the type of dividends and gains they have received. To effectively tackle this topic, begin by gathering all relevant financial documents, including Form 1099-DIV and any records of capital asset sales. Carefully follow the worksheet’s instructions, entering your taxable income and distinguishing between qualified and non-qualified dividends as well as short-term and long-term capital gains. Be diligent in applying the correct tax rates, which can vary significantly depending on your income bracket. It’s also beneficial to familiarize yourself with any recent tax law changes that may affect the treatment of these income types. Finally, consider consulting with a tax professional if you encounter complexities, such as the interaction of these gains with other sources of income.

Qualified Dividends And Capital Tax Worksheet is an essential tool for anyone looking to enhance their understanding of tax implications related to investments. Utilizing flashcards can significantly improve your learning experience by breaking down complex concepts into manageable pieces, making it easier to retain critical information. Flashcards promote active recall, which strengthens memory and helps you identify areas where further study is needed. By repeatedly testing yourself with flashcards, you can effectively gauge your skill level and comprehension of qualified dividends and capital gains taxes, allowing you to focus on topics that require more attention. This method not only accelerates your learning process but also boosts your confidence in applying these concepts in real-life financial situations. Ultimately, incorporating flashcards into your study routine can lead to a more profound understanding of the Qualified Dividends And Capital Tax Worksheet, enabling you to make informed decisions regarding your investments and tax planning strategies.

How to improve after Qualified Dividends And Capital Tax Worksheet

Opi opinto-oppaamme avulla lisää vinkkejä ja temppuja parantamiseen laskentataulukon suorittamisen jälkeen.

After completing the Qualified Dividends and Capital Gain Tax Worksheet, students should focus on several key areas to ensure a comprehensive understanding of the concepts involved.

1. Understanding Qualified Dividends: Review the definition of qualified dividends and how they differ from ordinary dividends. Study the criteria that dividends must meet to be classified as qualified, including holding period requirements and the types of stocks that qualify.

2. Capital Gains Basics: Familiarize yourself with the concept of capital gains and the difference between short-term and long-term capital gains. Understand how the holding period of an asset affects the taxation rate and the classification of gains.

3. Tax Rates: Research the current tax rates that apply to qualified dividends and long-term capital gains. This includes understanding the thresholds for different tax brackets and how these rates compare to ordinary income tax rates.

4. Completing the Worksheet: Go through the steps of the Qualified Dividends and Capital Gain Tax Worksheet in detail. Make sure you understand how to calculate the amounts needed for line entries and how to apply the correct tax rates to the calculated figures.

5. Tax Implications: Study the overall tax implications of receiving qualified dividends and capital gains. Understand how these types of income can impact total taxable income and the potential for tax liability.

6. Reporting on Tax Returns: Learn how qualified dividends and capital gains are reported on tax returns. Familiarize yourself with the relevant forms, such as Form 1040 and Schedule D, and understand where to report these items on the forms.

7. Investment Strategies: Explore investment strategies that could maximize the benefits of qualified dividends and long-term capital gains. Consider the importance of timing when buying and selling assets and how it relates to tax implications.

8. Recent Changes in Tax Law: Stay updated on any recent changes in tax law that may affect qualified dividends and capital gains. This could include adjustments to tax rates, changes in reporting requirements, or new regulations affecting investments.

9. Practical Examples: Work through practical examples of calculating taxes on qualified dividends and capital gains. Create hypothetical scenarios with different income levels and types of dividends or gains to solidify understanding.

10. Seek Additional Resources: Identify additional resources such as IRS publications, tax software guides, or financial planning websites that provide further information on qualified dividends and capital gains taxation.

By focusing on these areas, students will build a solid understanding of the concepts related to qualified dividends and capital gains, ensuring they are well-prepared for any related assessments or practical applications in the future.

Luo interaktiivisia laskentataulukoita tekoälyllä

With StudyBlaze you can create personalised & interactive worksheets like Qualified Dividends And Capital Tax Worksheet easily. Start from scratch or upload your course materials.