Liiketoiminnan tulotaulukko

Yritystulolaskentataulukot tarjoavat kattavan erittelyn keskeisistä käsitteistä ja laskelmista, joita tarvitaan yritystulojen tehokkaaseen analysointiin ja raportointiin verotusta varten.

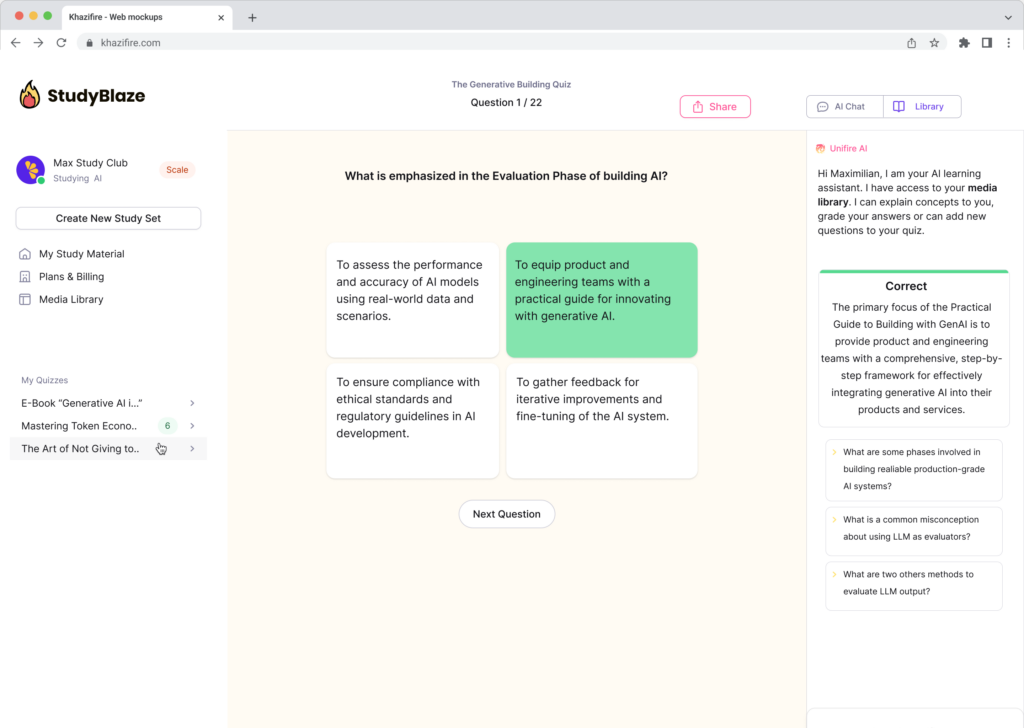

Voit ladata Työtaulukko PDF, The Työarkin vastausavain ja Tehtävätaulukko, jossa on kysymyksiä ja vastauksia. Tai luo omia interaktiivisia laskentataulukoita StudyBlazen avulla.

Yritystulolaskentataulukko – PDF-versio ja vastausavain

{työtaulukko_pdf_avainsana}

Lataa {worksheet_pdf_keyword}, joka sisältää kaikki kysymykset ja harjoitukset. Ei vaadi rekisteröitymistä tai sähköpostia. Tai luo oma versio käyttämällä StudyBlaze.

{worksheet_answer_keyword}

Lataa {worksheet_answer_keyword}, joka sisältää vain vastaukset kuhunkin laskentataulukkoon. Ei vaadi rekisteröitymistä tai sähköpostia. Tai luo oma versio käyttämällä StudyBlaze.

{worksheet_qa_keyword}

Lataa {worksheet_qa_keyword}, niin saat kaikki kysymykset ja vastaukset kauniisti erotettuina – ei vaadi rekisteröitymistä tai sähköpostia. Tai luo oma versio käyttämällä StudyBlaze.

Liiketoiminnan tulotaulukon käyttäminen

Business Income Worksheet on suunniteltu auttamaan yrittäjiä ja pienyritysten omistajia systemaattisesti seuraamaan ja laskemaan tulovirtaansa tietyn ajanjakson aikana. Taulukko sisältää tyypillisesti osiot, joissa kerrotaan eri tulolähteistä, kuten myyntituloista, palvelutuloista ja mahdollisista lisätuloista. Käyttäjien tulee aloittaa luettelemalla kaikki tulolähteet niille tarkoitettuihin sarakkeisiin ja varmistamalla, että ne luokitellaan tarkasti, jotta tulotrendejä analysoidaan selkeästi. On suositeltavaa säilyttää johdonmukaisuus päivittämällä laskentataulukko säännöllisesti vastaamaan saapuvia maksuja ja meneillään olevia myyntiä. Lisäksi muistiinpano-osion sisällyttäminen voi olla hyödyllistä seurattaessa kausiluonteisia malleja tai epäsäännöllisiä tulojen vaihteluita. Aiheen tehokkaan käsittelemisen kannalta on tärkeää ymmärtää tarkan kirjanpidon merkitys, sillä se ei ainoastaan auta taloussuunnittelua vaan varmistaa myös säännösten noudattamisen verokauden aikana. Työarkin säännöllinen tarkistaminen antaa näkemyksiä liiketoiminnan suorituskyvystä, mikä mahdollistaa tietoisen päätöksenteon ja strategiset mukautukset tarpeen mukaan.

Business Income Worksheet tarjoaa jäsennellyn lähestymistavan taloustietojen ymmärtämiseen ja hallintaan, joten se on korvaamaton työkalu henkilöille, jotka haluavat parantaa liiketoimintakykyään. Tämän laskentataulukon avulla käyttäjät voivat hahmotella selkeästi tulovirtansa, kulunsa ja yleisen kannattavuutensa, mikä puolestaan antaa mahdollisuuden tunnistaa parannus- ja kasvukohteita. Tämä selkeys ei vain auta asettamaan realistisia taloudellisia tavoitteita, vaan auttaa myös seuraamaan edistymistä ajan mittaan. Lisäksi Business Income Worksheet antaa yksilöille mahdollisuuden arvioida osaamistasoaan tarjoamalla kattavan yleiskatsauksen taloudellisista tottumuksistaan ja päätöksentekoprosesseistaan. Tämä itsearviointi rohkaisee käyttäjiä pohtimaan strategioitaan, tunnistamaan vahvuudet ja paikantamaan heikkoudet, mikä johtaa viime kädessä tietoisempien taloudellisten päätösten tekemiseen. Lisäksi kun käyttäjät tutustuvat laskentataulukkoon paremmin, he luottavat entistä enemmän talouslukutaitoonsa, mikä tasoittaa tietä paremmille liiketoimintamahdollisuuksille ja menestykselle.

Kuinka parantua yritystulotaulukon jälkeen

Opi opinto-oppaamme avulla lisää vinkkejä ja temppuja parantamiseen laskentataulukon suorittamisen jälkeen.

Voidakseen opiskella tehokkaasti Business Income -laskentataulukon suorittamisen jälkeen opiskelijoiden tulee keskittyä useisiin avainalueisiin, jotka liittyvät laskentataulukon käsitteisiin ja laskelmiin. Tässä oppaassa hahmotellaan kattavan katsauksen keskeiset aiheet ja strategiat.

Ymmärrä yritystulotyypit: Aloita tutustumalla erityyppisiin yritystuloihin. Tämä sisältää liiketulot, sijoitustulot ja kaikki muut yrityksellesi merkitykselliset tulolähteet. Tunnista, kuinka kukin tyyppi vaikuttaa kokonaistuloihin.

Tarkista tuloutusperiaatteet: Tutustu tuloutusperiaatteisiin. Ymmärtää milloin ja miten tuotot kirjataan tilinpäätökseen, mukaan lukien erot kassa- ja suoriteperusteisten laskentamenetelmien välillä.

Analysoi kulut ja vähennykset: Käy läpi erilaiset liiketoiminnan kulut, jotka voidaan vähentää bruttotuloista saadaksesi nettotulot. Tämä sisältää kiinteät ja muuttuvat kustannukset, toimintakulut ja investointikustannukset. Muista tehdä ero välttämättömien kulujen ja luonteeltaan henkilökohtaisten kulujen välillä.

Tutustu verovaikutuksiin: Selvitä yritystuloihin liittyviä verovelvoitteita. Ymmärrä erilaisia verorakenteita, joita voidaan soveltaa erityyppisiin yrityksiin, kuten yksityisiin yrityksiin, yhtiöihin ja yhtiöihin. Tutustu yleisiin vähennyksiin, jotka voivat alentaa verotettavaa tuloa.

Harjoittele nettotulon laskemista: Käytä esimerkkiskenaarioita harjoitellaksesi nettotulon laskemista laskentataulukossa olevien tietojen perusteella. Tähän tulisi sisältyä bruttotulojen, vähennettävien kulujen ja niistä saatujen nettotulojen laskeminen. Käy läpi erilaisia esimerkkejä varmistaaksesi, että ymmärrät laskelmat perusteellisesti.

Tarkastele tilinpäätöstä: Tutki kuinka yritystulot esitetään tilinpäätöksessä, erityisesti tuloslaskelmassa. Opi analysoimaan tuloslaskelmaa liiketoiminnan suorituskyvyn arvioimiseksi ja ymmärtämään keskeisiä mittareita, kuten bruttovoittomarginaali ja liikevoittomarginaali.

Ymmärrä tarkan kirjanpidon tärkeys: Tunnista tarkan talouskirjanpidon merkitys yrityksellesi. Tämä sisältää ymmärryksen siitä, kuinka asianmukaiset asiakirjat voivat tukea tulovaatimuksia ja vähennyksiä verovalmistelujen ja -tarkastusten aikana.

Tarkista asiaankuuluvat lait ja määräykset: Tutustu kaikkiin asiaankuuluviin lakeihin ja määräyksiin, jotka säätelevät yritystuloraportointia ja verotusta. Tämä voi sisältää paikallisia, osavaltion ja liittovaltion ohjeita, jotka vaikuttavat siihen, miten yritykset raportoivat tuloistaan ja kuluistaan.

Osallistu ryhmäkeskusteluihin: Harkitse opintoryhmien muodostamista vertaisten kanssa keskustellakseen yritystulotaulukkoon liittyvistä käsitteistä ja laskelmista. Keskusteluihin osallistuminen voi vahvistaa ymmärrystäsi ja auttaa sinua oppimaan muiden näkökulmista.

Käytä online-resursseja: Hyödynnä online-opetusohjelmia, videoita ja artikkeleita, jotka selittävät liiketoiminnan tuloihin ja taloudelliseen raportointiin liittyvät käsitteet. Nämä resurssit voivat tarjota lisäselvyyttä ja esimerkkejä, jotka voivat parantaa ymmärrystäsi.

Harjoittele ongelmanratkaisua: Harjoittele lopuksi harjoitusongelmia, jotka edellyttävät hankkimiesi tietojen soveltamista. Tämä voi sisältää omien hypoteettisten liiketoimintaskenaarioiden luomisen ja liiketoiminnan tulojen eri näkökohtien laskemisen tai samankaltaisia harjoituksia tarjoavien harjoituslaskentataulukoiden etsimisen verkosta.

Kaiken kaikkiaan kattava ymmärrys yritystuloista ei ainoastaan auta sinua täyttämään laskentataulukkoa, vaan antaa myös vankan pohjan yritysrahoituksen ja kirjanpidon jatko-opintoihin. Keskity näihin alueisiin vahvistaaksesi tietämystäsi ja valmistautuaksesi kaikkiin arviointeihin tai tosielämän sovelluksiin.

Luo interaktiivisia laskentataulukoita tekoälyllä

StudyBlazen avulla voit helposti luoda yksilöllisiä ja interaktiivisia laskentataulukoita, kuten Business Income Worksheet. Aloita alusta tai lataa kurssimateriaalisi.