Arbejdsark med sammensat rente

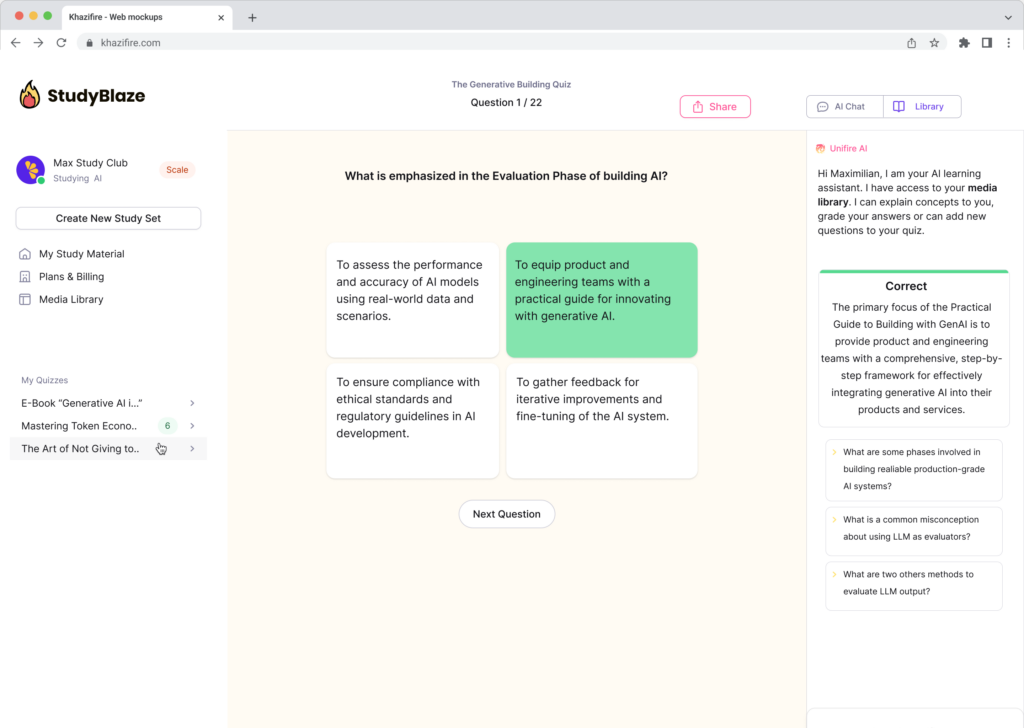

Rentesammensatte regneark giver engagerende flashcards, der hjælper brugerne med at mestre begreberne og beregningerne relateret til renters rente.

Du kan hente den Arbejdsark PDF, Arbejdsark Svarnøgle og Arbejdsark med spørgsmål og svar. Eller byg dine egne interaktive arbejdsark med StudyBlaze.

Sammensatte interesseark – PDF-version og svarnøgle

{arbejdsark_pdf_søgeord}

Download {worksheet_pdf_keyword}, inklusive alle spørgsmål og øvelser. Ingen tilmelding eller e-mail nødvendig. Eller opret din egen version vha StudyBlaze.

{worksheet_answer_keyword}

Download {worksheet_answer_keyword}, som kun indeholder svarene til hver opgavearkøvelse. Ingen tilmelding eller e-mail nødvendig. Eller opret din egen version vha StudyBlaze.

{worksheet_qa_keyword}

Download {worksheet_qa_keyword} for at få alle spørgsmål og svar, pænt adskilt – ingen tilmelding eller e-mail påkrævet. Eller opret din egen version vha StudyBlaze.

Sådan bruger du regneark med sammensat rente

Arbejdsarket for renters rente fungerer som et praktisk værktøj til at forstå principperne for renters rente gennem forskellige scenarier. Dette regneark indeholder typisk sektioner til indtastning af hovedstol, rentesats, sammensætningsfrekvens og investeringsvarighed, hvilket giver brugerne mulighed for at beregne den samlede akkumulerede værdi over tid. For effektivt at tackle emnet, er det en fordel at sætte sig ind i formlen for renters rente, som er A = P(1 + r/n)^(nt), hvor A repræsenterer det samlede beløb, P er hovedstolen, r er den årlige rentesats, n er antallet af gange, renten forhøjes pr. år, og t er antallet af år. Derudover kan arbejdet med forskellige eksempler på arbejdsarket styrke din forståelse; prøv at variere renten og sammensætningsfrekvensen for at se, hvordan de påvirker det endelige beløb. Denne praktiske tilgang øger ikke kun forståelsen, men opbygger også tillid til at anvende disse begreber i virkelige økonomiske situationer.

Rentesammensatte regneark tilbyder en effektiv og engagerende måde for enkeltpersoner at forbedre deres forståelse og anvendelse af begreber med renters rente. Ved at bruge disse regneark kan eleverne aktivt øve sig i at beregne renters rente, som styrker deres forståelse af økonomiske principper, samtidig med at de giver dem mulighed for at visualisere virkningen af rentesatser over tid. Denne praktiske tilgang hjælper enkeltpersoner med at lokalisere deres nuværende færdighedsniveau, da de kan spore deres fremskridt gennem forskellige problemsæt og identificere områder, hvor de kan kæmpe. Derudover fremmer den iterative karakter af at bruge flashcards opbevaring af information, hvilket gør det muligt for brugere at huske formler og processer mere effektivt. Samlet set øger det at engagere sig i Compound Interest Worksheets ikke kun tilliden til finanskompetencer, men det udstyrer også eleverne med væsentlige færdigheder til at træffe informerede økonomiske beslutninger i deres personlige og professionelle liv.

Sådan forbedres efter regneark med sammensat rente

Lær yderligere tips og tricks til, hvordan du forbedrer dig efter at have afsluttet arbejdsarket med vores studievejledning.

Efter at have udfyldt regnearket for renters rente skal eleverne fokusere på følgende nøgleområder for at uddybe deres forståelse af renters rente og dens anvendelser.

1. Definition af renters rente: Forstå, hvad renters rente er, og hvordan den adskiller sig fra simpel rente. Gennemgå formlen for renters rente, som er A = P(1 + r/n)^(nt), hvor A er mængden af penge, der er akkumuleret efter n år, inklusive renter, P er hovedstolen (den oprindelige sum af penge ), r er den årlige rentesats (decimal), n er antallet af gange, renten forhøjes om året, og t er antallet af år, pengene er investeret eller lånt.

2. Komponenter i formlen: Neddel hver komponent i formlen med renters rente. Forstå, hvordan ændringer i hovedstol, rentesats, sammensætningshyppighed og tid påvirker det samlede akkumulerede beløb.

3. Real-Life-applikationer: Udforsk virkelige scenarier, hvor renters rente er gældende, såsom opsparingskonti, lån, realkreditlån og investeringer. Diskuter vigtigheden af at forstå renters rente i finansiel planlægning og beslutningstagning.

4. Sammenligning af renters rente og simpel rente: Lav en sammenligning mellem renters rente og simpel rente. Analyser eksempler for at se, hvordan renters rente kan føre til markant højere afkast over tid sammenlignet med simpel rente, især med længere tidsperioder og højere renter.

5. Sammensætningshyppighed: Undersøg, hvordan hyppigheden af sammensætning (årligt, halvårligt, kvartalsvis, månedligt, dagligt) påvirker det samlede rentebeløb, der er tjent eller betalt. Beregn virkningerne af forskellige sammensætningsfrekvenser på samme hovedstol og rente over en bestemt periode.

6. Fremtidig værdi og nutidsværdi: Lær om begreberne fremtidig værdi og nutidsværdi i sammenhæng med renters rente. Forstå, hvordan man beregner den fremtidige værdi af en investering og nutidsværdien af et beløb, der skal modtages i fremtiden.

7. Grafisk repræsentation: Lav grafer for at visualisere, hvordan renters rente vokser over tid. Brug forskellige rentesatser og sammensætningsfrekvenser til at sammenligne vækstkurver.

8. Problemløsningspraksis: Arbejd med yderligere praksisproblemer, der involverer beregning af renters rente i forskellige scenarier. Inkluder problemer med forskellige hovedstole, rentesatser, tidsperioder og sammensætningsfrekvenser.

9. Finansiel forståelse: Diskuter vigtigheden af finansiel forståelse, og hvordan forståelse af renters rente kan føre til bedre økonomiske beslutninger. Udforsk emner som pensionsopsparing, uddannelsesfonde og virkningen af gæld.

10. Teknologi og værktøjer: Gør dig bekendt med finansielle lommeregnere og regnearkssoftware, der kan bruges til hurtigt at beregne renters rente. Lær, hvordan du opsætter formler i regneark for at automatisere beregninger for forskellige scenarier.

Ved at studere disse områder vil de studerende styrke deres forståelse af renters rente og dens relevans i virkelige økonomiske situationer.

Opret interaktive regneark med AI

Med StudyBlaze kan du nemt oprette personlige og interaktive arbejdsark som Compound Interest Worksheet. Start fra bunden eller upload dit kursusmateriale.