Příjmy a výdaje list

Income And Expense Worksheet flashcards provide essential tips and examples for effectively tracking and managing personal finances.

Zde si můžete stáhnout Pracovní list PDFse Klíč odpovědi na pracovní list a Pracovní list s otázkami a odpověďmi. Nebo si vytvořte své vlastní interaktivní pracovní listy pomocí StudyBlaze.

Income And Expense Worksheet – PDF Version and Answer Key

{worksheet_pdf_keyword}

Stáhněte si {worksheet_pdf_keyword}, včetně všech otázek a cvičení. Není nutná registrace ani e-mail. Nebo si vytvořte vlastní verzi pomocí StudyBlaze.

{worksheet_answer_keyword}

Stáhněte si {worksheet_answer_keyword} obsahující pouze odpovědi na každé cvičení s pracovním listem. Není nutná registrace ani e-mail. Nebo si vytvořte vlastní verzi pomocí StudyBlaze.

{worksheet_qa_keyword}

Stáhněte si {worksheet_qa_keyword} a získejte všechny otázky a odpovědi pěkně oddělené – není potřeba žádná registrace ani e-mail. Nebo si vytvořte vlastní verzi pomocí StudyBlaze.

How to use Income And Expense Worksheet

The Income And Expense Worksheet functions as a practical financial tool designed to help individuals track their earnings and expenditures systematically. By categorizing income sources—such as salaries, bonuses, and any freelance work—alongside monthly and variable expenses like rent, utilities, groceries, and entertainment, users can gain a clear overview of their financial situation. To effectively tackle the topic, it is advisable to begin by gathering all relevant financial documents, including pay stubs, bank statements, and bills, to ensure that all income and expenses are accounted for accurately. Once the data is collected, inputting it into the worksheet can help identify patterns in spending, highlight areas where cuts can be made, and ultimately aid in setting realistic financial goals. Regular updates to the worksheet will enhance its value, allowing for better budgeting decisions and financial planning over time.

Income And Expense Worksheet is an invaluable tool for anyone looking to gain control over their financial situation. By utilizing this worksheet, individuals can clearly track their earnings and expenditures, which not only helps in identifying spending patterns but also aids in setting and achieving financial goals. This structured approach allows users to determine their skill level in budgeting and financial management, as they can easily see areas where they excel and those that require improvement. The worksheet fosters accountability and encourages mindful spending, ultimately leading to more informed financial decisions. With regular use, individuals can enhance their financial literacy, boost their confidence in managing money, and pave the way for a more secure financial future.

How to improve after Income And Expense Worksheet

Naučte se další tipy a triky, jak se po dokončení pracovního listu zlepšit, pomocí našeho studijního průvodce.

To effectively study after completing the Income and Expense Worksheet, students should focus on several key areas that will deepen their understanding of personal finance management.

First, students should review the basic concepts of budgeting. This includes understanding what a budget is, its purpose, and how it can help in managing finances. They should be able to define key terms such as income, fixed expenses, variable expenses, and discretionary spending.

Next, students should analyze their own income sources. They need to identify and categorize different types of income, which may include salaries, wages, freelance income, interest, dividends, and any other sources. By understanding their total income, students can better plan their spending and saving strategies.

Following this, students should examine the types of expenses they listed on the worksheet. They should categorize these expenses into fixed and variable expenses. Fixed expenses are those that remain constant each month, such as rent or mortgage payments, insurance premiums, and loan payments. Variable expenses may include groceries, entertainment, and other discretionary spending. Understanding these categories will help students identify areas where they can cut back if needed.

Students should also calculate their net income, which is the total income minus total expenses. This figure is crucial as it indicates whether they have a surplus or a deficit each month. If there is a deficit, students need to explore strategies for reducing expenses or increasing income.

In addition, students should familiarize themselves with the concept of savings and its importance in personal finance. They should learn about different saving strategies, such as setting aside a percentage of their income for emergencies, retirement, and future goals. Understanding the difference between short-term and long-term savings goals is also essential.

Students should also research investment options and the importance of investing as part of their financial strategy. This includes understanding various investment vehicles such as stocks, bonds, mutual funds, and real estate. They should recognize the risk and return associated with different types of investments and how they fit into their overall financial plan.

Moreover, students should explore the impact of debt on their financial health. They need to understand how to manage debt responsibly, including distinguishing between good debt and bad debt. Learning about interest rates, minimum payments, and strategies for paying off debt, such as the snowball and avalanche methods, is vital.

Another area of study should be financial goal setting. Students should learn how to set SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound. They should practice creating short-term, medium-term, and long-term financial goals and understand the steps needed to achieve them.

Students should also consider the importance of financial literacy and the role it plays in making informed financial decisions. They should seek out resources such as books, online courses, and workshops on personal finance to enhance their knowledge and skills.

Lastly, students should be encouraged to practice reviewing and updating their Income and Expense Worksheet regularly. This habit will help them stay on track with their budget, make informed spending decisions, and adjust their financial plans as necessary.

By focusing on these areas, students will gain a comprehensive understanding of personal finance management and be better prepared to handle their financial futures effectively.

Vytvářejte interaktivní pracovní listy s umělou inteligencí

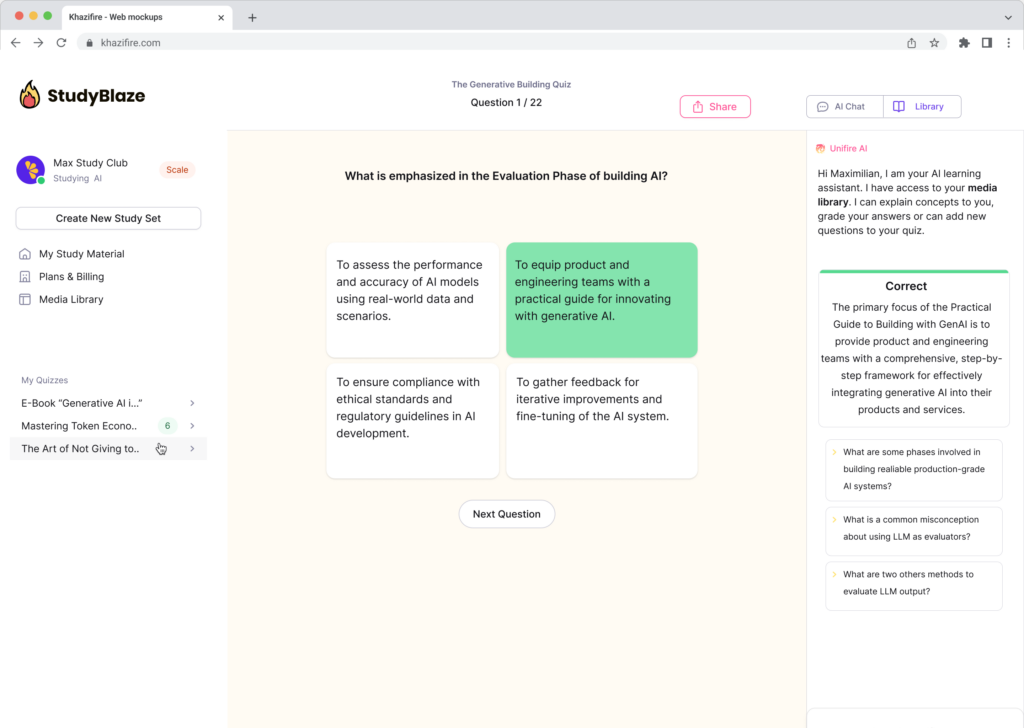

With StudyBlaze you can create personalised & interactive worksheets like Income And Expense Worksheet easily. Start from scratch or upload your course materials.