Работен лист за квалифицирани дивиденти и капиталови печалби

Qualified Dividends And Capital Gains Worksheet flashcards provide essential insights and strategies for accurately reporting investment income on your tax return.

Можете да изтеглите Работен лист PDF- Работен лист Ключ за отговор и Работен лист с въпроси и отговори. Или създайте свои собствени интерактивни работни листове със StudyBlaze.

Qualified Dividends And Capital Gains Worksheet – PDF Version and Answer Key

{worksheet_pdf_keyword}

Изтеглете {worksheet_pdf_keyword}, включително всички въпроси и упражнения. Не се изисква регистрация или имейл. Или създайте своя собствена версия, като използвате StudyBlaze.

{worksheet_answer_keyword}

Изтеглете {worksheet_answer_keyword}, съдържащ само отговорите на всяко упражнение от работен лист. Не се изисква регистрация или имейл. Или създайте своя собствена версия, като използвате StudyBlaze.

{worksheet_qa_keyword}

Изтеглете {worksheet_qa_keyword}, за да получите всички въпроси и отговори, добре разделени – не се изисква регистрация или имейл. Или създайте своя собствена версия, като използвате StudyBlaze.

How to use Qualified Dividends And Capital Gains Worksheet

The Qualified Dividends and Capital Gains Worksheet is designed to help taxpayers accurately calculate the tax owed on qualified dividends and long-term capital gains, which are often taxed at a lower rate than ordinary income. This worksheet breaks down the income types, allowing users to categorize their dividends and gains separately, ensuring they apply the correct tax brackets. To effectively tackle this topic, start by gathering all relevant income statements, including 1099-DIV forms that report dividends and 1099-B forms for capital gains. Carefully fill out each section of the worksheet, paying special attention to distinguishing between qualified and non-qualified dividends, as this can significantly impact your tax liability. Additionally, familiarize yourself with the associated tax rates for various income levels, as understanding the thresholds will aid in optimizing your tax strategy. Finally, reviewing the worksheet instructions thoroughly can clarify any nuances related to specific gains or losses that might affect your overall tax situation.

Qualified Dividends And Capital Gains Worksheet can significantly enhance an individual’s understanding of tax implications related to investments, making it an invaluable tool for both novice and seasoned investors. By utilizing this worksheet, individuals can easily categorize their income, enabling them to determine their skill level in managing dividends and capital gains effectively. This structured approach helps users identify areas where they excel and pinpoint aspects that may require further learning or improvement. Moreover, the clarity provided by the worksheet simplifies complex tax calculations, allowing users to make informed financial decisions and optimize their tax strategies. As a result, individuals can feel more confident in their investment choices, ultimately leading to better financial outcomes and a deeper understanding of their overall fiscal health. Engaging with the Qualified Dividends And Capital Gains Worksheet not only aids in self-assessment but also encourages proactive financial management, making it an essential resource for anyone looking to enhance their investment acumen.

How to improve after Qualified Dividends And Capital Gains Worksheet

Научете допълнителни съвети и трикове как да се подобрите, след като завършите работния лист с нашето учебно ръководство.

To effectively study the content related to the Qualified Dividends and Capital Gains Worksheet, students should focus on several key areas. Understanding the nuances of qualified dividends and capital gains is essential for accurate tax reporting and financial planning. Here’s a detailed guide on what to study after completing the worksheet:

1. Basics of Qualified Dividends: Review what qualifies a dividend as a “qualified dividend”. This includes understanding the holding period, the type of stock or mutual fund that pays the dividend, and the requirement that the dividend must be paid by a U.S. corporation or a qualified foreign corporation.

2. Tax Rates for Qualified Dividends: Study the different federal tax rates that apply to qualified dividends compared to ordinary income. Familiarize yourself with the current tax brackets for qualified dividends and how they relate to overall income levels.

3. Capital Gains Overview: Understand the difference between short-term and long-term capital gains. Short-term capital gains are typically taxed at ordinary income tax rates, while long-term capital gains benefit from lower tax rates.

4. Holding Period for Capital Gains: Focus on the importance of the holding period in determining whether a gain is short-term or long-term. Review the general rule that assets held for more than one year are considered long-term.

5. Types of Capital Gains: Explore the different types of capital gains, including those from the sale of stocks, bonds, real estate, and other investments. Understand how different assets may have varying implications for taxation.

6. Net Investment Income Tax: Investigate the Net Investment Income Tax (NIIT) and how it may apply to individuals with high income levels. Study the thresholds for this tax and the types of income it affects.

7. Reporting Requirements: Go over the specific IRS forms and schedules required for reporting qualified dividends and capital gains. This includes understanding how to fill out the appropriate sections of Form 1040 and any additional schedules that may be needed.

8. Tax Credits and Deductions: Review any tax credits or deductions that may be available to offset taxes on qualified dividends and capital gains. Understand how these can affect overall tax liability.

9. Impact of State Taxes: Consider the implications of state taxes on dividends and capital gains. Different states have varying rules and rates, so students should be aware of how their state tax laws may affect their overall tax situation.

10. Investment Strategies: Discuss investment strategies that can minimize tax liabilities related to dividends and capital gains. This may include tax-loss harvesting and the use of tax-advantaged accounts.

11. Recent Tax Law Changes: Stay updated on any recent changes in tax law that may affect qualified dividends and capital gains. This includes proposed legislation or recent IRS guidance that could impact tax rates or reporting requirements.

12. Practical Applications: Engage in practical exercises that involve calculating taxes owed on qualified dividends and capital gains. Use hypothetical scenarios to apply knowledge and reinforce understanding.

By focusing on these areas, students will gain a comprehensive understanding of the Qualified Dividends and Capital Gains Worksheet and the broader implications of dividends and capital gains in personal finance and taxation.

Създавайте интерактивни работни листове с AI

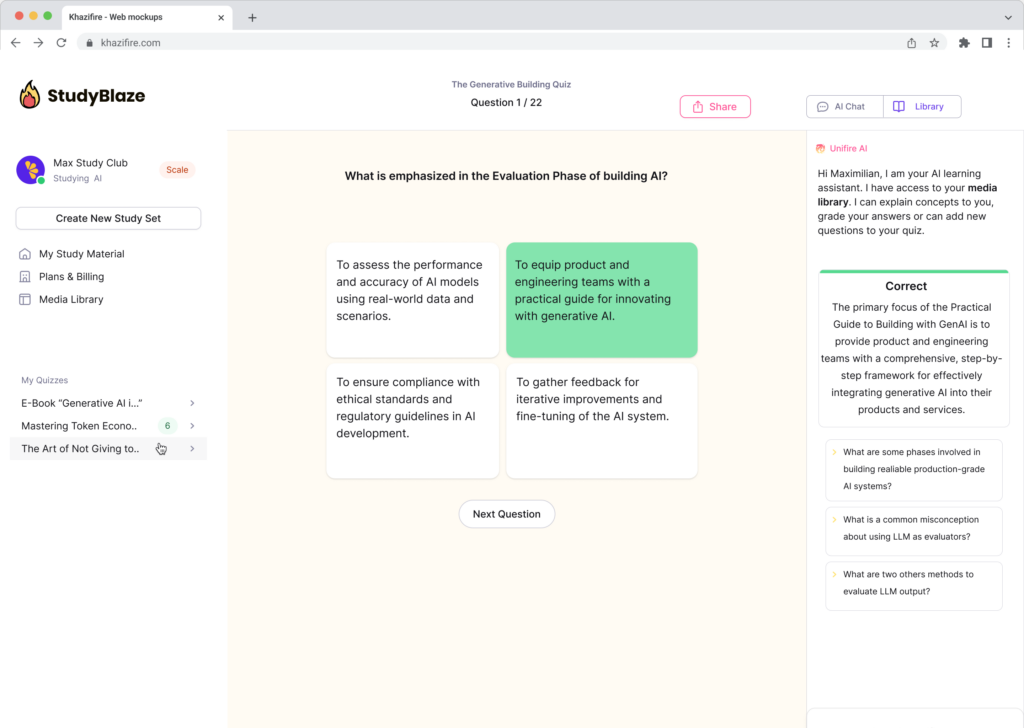

With StudyBlaze you can create personalised & interactive worksheets like Qualified Dividends And Capital Gains Worksheet easily. Start from scratch or upload your course materials.